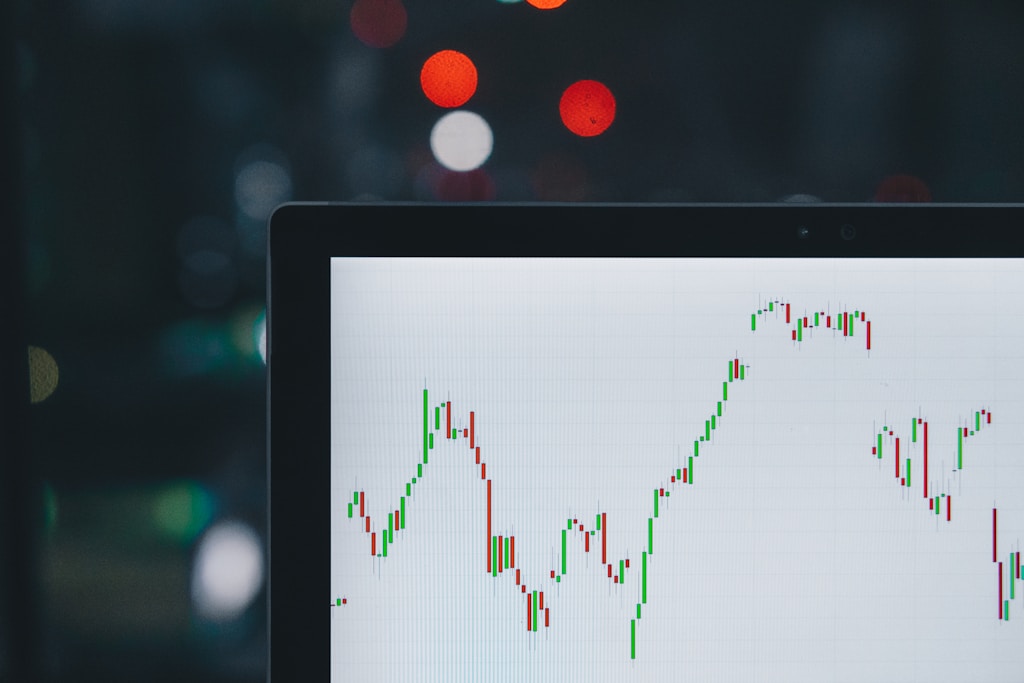

Bitcoin Crisis: $80K Support Crumbles – 20% Drop Next?

Bitcoin faces critical test at $80,000 support level as price drops from $92,500. Technical indicators suggest possible further decline amid mounting selling…

Market Alert: Bitcoin’s Critical Support Level Under Threat

Bitcoin’s price trajectory has taken a concerning turn as the flagship cryptocurrency plunges below multiple support levels, with the critical $80,000 zone now representing what could be the last line of defense for bulls. This dramatic decline, which began at the $92,500 mark, has sent shockwaves through the crypto market and may signal a deeper correction ahead.

As noted in recent market analysis, the ETF-driven selling pressure continues to mount, creating significant downward momentum.

Technical Breakdown of Bitcoin’s Current Position

- Price has broken below the crucial $88,000 support level

- Trading activity now occurs below the 100-hour Simple Moving Average

- A bearish trend line has formed with resistance at $86,150

- Current consolidation phase around $83,500 level

SPONSORED

Trade Bitcoin with up to 100x leverage and maximize your profit potential

Key Support and Resistance Levels

Critical Support Zones:

- Primary Support: $82,000

- Major Support: $80,000

- Last Resort Support: $78,500

Resistance Levels:

- Immediate Resistance: $85,000

- Key Resistance: $86,150

- Major Resistance: $87,150

Expert Analysis and Market Implications

According to cryptocurrency analyst Sarah Chen from Digital Assets Research: “The current price action suggests we’re entering a critical phase where the $80,000 support level could determine Bitcoin’s medium-term trajectory. A failure to hold this level could trigger a cascade of liquidations.”

Technical indicators paint a concerning picture:

- MACD showing weakening momentum in bearish territory

- RSI below 50, indicating bearish sentiment

- Volume profile suggesting increased selling pressure

Potential Scenarios and Trading Implications

Bullish Case:

- Recovery above $86,000 could target $88,500

- Break above $90,000 would signal trend reversal

- Institutional buying might provide support at current levels

Bearish Case:

- Break below $80,000 could trigger panic selling

- Technical indicators suggest further downside potential

- ETF outflows continue to pressure price action

Market Impact and Future Outlook

The current market structure suggests Bitcoin is at a crucial inflection point. With technical indicators showing bearish signals and the psychological $80,000 support level under threat, traders should maintain strict risk management practices and prepare for potential increased volatility.

Source: NewsBTC