Liquidity Rules for Token Listings on DEXs

Understand the essential liquidity rules and strategies for successfully listing tokens on decentralized exchanges (DEXs).

- Liquidity is essential: It ensures smooth trading, stable prices, and prevents manipulation on decentralized exchanges (DEXs). Without it, tokens may face price swings and poor trading conditions.

- Core liquidity requirements:

-

Strategies to meet liquidity needs:

- Liquidity Mining: Offer rewards to attract providers.

- Market Makers: Collaborate with professionals for stability.

- Community Involvement: Engage users with educational content, referral programs, and governance rights.

-

DEX-specific rules:

- Uniswap: Fixed liquidity thresholds and 0.3% trading fees.

- SushiSwap: Flexible liquidity and gradual LP token release.

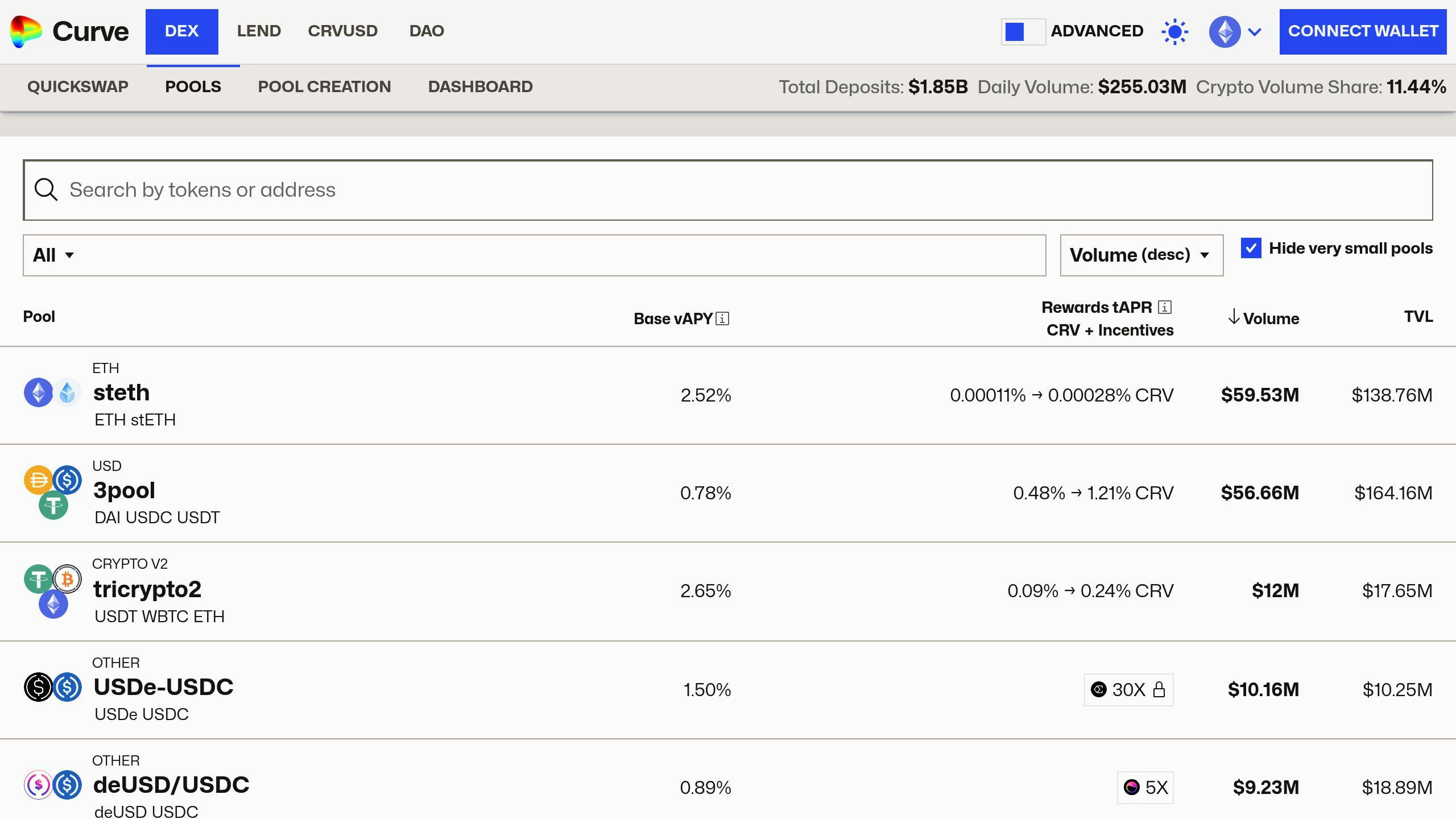

- Curve: $1M minimum liquidity and strict balance ratios for stablecoin pools.

- Defx Perps DEX: Higher thresholds for leveraged trading and pre-launch verification.

-

Post-listing management:

- Track liquidity metrics like trading volume, pool size, and price volatility.

- Use rewards like yield farming and trading fee shares to retain liquidity providers.

- Gradually unlock tokens and conduct buybacks to maintain price stability.

Quick Comparison of DEX Liquidity Rules

| DEX | Minimum Liquidity | Trading Fees | Special Features |

|---|---|---|---|

| Uniswap | $100,000 | 0.3% | Fixed thresholds, immediate LP token release |

| SushiSwap | Flexible | 0.25% | Gradual LP token release, added rewards |

| Curve | $1M per pool | 0.04%-0.4% | Stablecoin-focused, strict balance ratios |

| Defx Perps DEX | Higher thresholds | Varies | Leverage up to 50x, pre-launch verification |

Takeaway: To succeed, focus on meeting liquidity thresholds, maintaining steady pools, and aligning with the specific requirements of your chosen DEX.

Launch Your Token on DEX: Understanding Liquidity Requirements

Core Liquidity Requirements

To successfully list a token on decentralized exchanges (DEXs), meeting specific liquidity rules is a must. These guidelines help maintain market stability and protect traders from wild price swings.

Required Liquidity Amounts

DEXs often set minimum liquidity thresholds to ensure smooth trading and reliable price discovery. For example, Uniswap requires at least $100,000 in liquidity. Higher liquidity means less slippage, which makes the token more appealing to traders. Along with the total liquidity, the choice of trading pairs significantly impacts the token’s performance.

Token Pair Requirements

Pairing your token with assets that already have strong liquidity is key to a successful launch. Popular trading pairs include:

| Base Token | Details |

|---|---|

| USDC | Stable pricing, requires $50,000 minimum liquidity |

| ETH | High trading activity, requires $75,000 minimum liquidity |

| USDT | Globally accessible, requires $50,000 minimum liquidity |

These pairings give traders familiar options and ensure easy market access. Tokens like USDC and ETH are often preferred because of their established reputation and deep liquidity pools.

Ongoing Liquidity Rules

Keeping liquidity levels steady after the initial listing is just as important as meeting the initial requirements. DEXs usually expect token issuers to:

- Monitor Liquidity Daily: Ensure minimum levels are met for all trading pairs.

- Maintain Pool Ratios: Keep balanced token ratios in liquidity pools to avoid slippage and price distortions.

- Offer Incentives: Reward liquidity providers to encourage their ongoing support.

Automated systems and community governance often oversee these rules. Falling short can lead to trading restrictions or even delisting. These measures help tokens stay competitive and functional in the ever-changing DEX landscape.

Meeting Liquidity Requirements

Projects need to develop focused strategies to meet their initial liquidity needs and maintain them over time.

Setting Up Liquidity Mining

Liquidity mining programs play a vital role in attracting and keeping liquidity providers. To run these programs effectively, projects should define clear reward structures and distribution processes.

| Program Component | Requirement | Purpose |

|---|---|---|

| Reward Rate | 0.1-1% monthly | Manageable token distribution |

| Lock-up Period | 30-90 days | Discourage immediate selling |

| Distribution Frequency | Daily/weekly | Keep participants engaged |

While individual contributors are drawn to liquidity mining, working with professional market makers ensures liquidity remains steady and trading activity is consistent.

Working with Market Makers

Market makers play a key role in stabilizing trading by managing order books and ensuring liquidity. They create smoother trading experiences by actively maintaining order books and providing continuous liquidity.

To collaborate effectively, market makers typically require:

- A minimum allocation of tokens for trading purposes

- Open communication channels with the project team

- Access to real-time market data and analytics

- Clear performance metrics and regular reporting

In addition to professional support, involving the community in liquidity efforts can lead to more sustainable outcomes.

Building Community Liquidity

Community-driven initiatives enhance professional strategies by promoting long-term engagement and decentralized participation. Projects can encourage community involvement through various methods, such as:

- Offering educational content about liquidity provision

- Launching referral programs for existing liquidity providers

- Granting governance rights to liquidity providers

- Setting up open communication channels for feedback

Combining these approaches while keeping a close eye on market conditions and community input ensures liquidity remains healthy. Regularly analyzing liquidity metrics allows projects to pinpoint weaknesses and fine-tune their strategies for better results.

sbb-itb-dd9e24a

DEX Liquidity Rules Comparison

Once you know how to meet liquidity requirements, it’s helpful to look at how the rules differ across major DEX platforms.

Uniswap and SushiSwap Rules

Uniswap sets fixed minimum liquidity thresholds, while SushiSwap allows more flexibility in liquidity provision. For instance, Compound (COMP) successfully launched on Uniswap by pairing a strong initial liquidity pool with a strategic distribution of LP tokens.

| Requirement | Uniswap | SushiSwap |

|---|---|---|

| Initial Liquidity | Fixed minimum threshold | Flexible, adjustable amounts |

| LP Token Distribution | Immediate | Gradual release possible |

| Trading Fee Structure | 0.3% standard | 0.25% with extra rewards |

| Market Maker Integration | Optional | Encouraged with incentives |

Curve and PancakeSwap Rules

Curve, known for its stablecoin pools, mandates a minimum liquidity of $1 million per pool and enforces strict balance ratios between assets to maintain price stability.

PancakeSwap takes a different approach with:

- Liquidity thresholds that adapt to market conditions

- Fee reductions for high-volume liquidity pools

- Regular assessments to ensure liquidity health

Defx Perps DEX Rules

Defx Perps DEX blends traditional liquidity requirements with features tailored for leveraged trading. This includes higher liquidity thresholds and pre-launch token verification for those offering leverage up to 50x.

| Feature | Requirement |

|---|---|

| Initial Verification | Pre-launch liquidity checks and ongoing monitoring |

| Leverage Support | Higher liquidity thresholds for leveraged positions |

| Risk Management | Liquidity adjustments based on trading activity and risk |

Knowing these platform-specific rules is just the beginning. Actively managing liquidity is essential for a token’s long-term success.

Post-Listing Liquidity Management

After a token is listed, keeping liquidity stable requires ongoing effort, regular adjustments, and active oversight. Successful projects stay on top of their liquidity strategies to maintain healthy trading conditions.

Tracking Liquidity Metrics

Monitoring key market indicators is a core part of effective liquidity management.

| Metric | Purpose | Action Threshold |

|---|---|---|

| 24h Trading Volume | Measures market activity | Drops below 30% of pool size – time for review |

| Liquidity Pool Size | Indicates trading depth | Should be at least 2x daily volume |

| Price Volatility | Tracks market stability | Swings over 5% in 1 hour need investigation |

| Order Book Depth | Reflects trading efficiency | Spread under $50k for 2% price impact is ideal |

Real-time tools like Dexed help track these metrics, enabling swift responses to market shifts. Understanding these indicators also helps projects design reward systems that support liquidity and encourage active participation.

Liquidity Provider Rewards

Attracting and retaining liquidity providers (LPs) is key to maintaining stable liquidity. Here are some common strategies:

| Strategy | Benefit | How It Works |

|---|---|---|

| Yield Farming | Keeps LPs engaged long-term | Daily rewards based on pool share |

| Trading Fee Shares | Offers immediate incentives | LPs earn 0.25-0.3% of transaction volume |

| Staking Bonuses | Encourages longer commitments | Extra tokens for time-locked positions |

While rewards are crucial, managing the token supply is just as important to ensure liquidity stability over time.

Token Supply Control

A well-thought-out approach to token supply can prevent price instability and sudden liquidity drops. This includes:

- Gradual token unlocks to avoid excessive selling pressure.

- Strategic token buybacks during periods of high liquidity.

- Regular monitoring of tokens in circulation to maintain balanced trading conditions.

Collaborating closely with market makers and keeping an eye on supply metrics can help projects sustain liquidity without depleting resources too quickly. This strategy supports long-term market stability and growth.

Conclusion

Key Takeaways and Success Strategies

DEX liquidity management revolves around three main areas: setting up initial liquidity, managing it effectively over time, and fostering strong community involvement.

For token issuers, maintaining liquidity pools that match or exceed daily trading volumes is critical. Market data suggests that successful projects often keep pools at least twice their daily trading volume, which helps ensure smooth trades and reduces the risk of large price swings. This approach minimizes volatility and keeps the market steady.

Reward systems combining yield farming with trading fee shares are another effective way to retain liquidity. These strategies have been especially useful for stabilizing markets during volatile periods.

Here are some practical strategies to enhance token listings on DEXs:

| Strategy | How to Implement | What It Achieves |

|---|---|---|

| Initial Liquidity | Partner with professional market makers | Provides round-the-clock market stability |

| LP Incentives & Yield Farming | Use dual rewards and fee sharing | Keeps liquidity pools consistently funded |

| Supply Management | Gradual token unlocks and buybacks | Helps stabilize token prices |

Tailor these strategies to the specific rules of your chosen DEX. For example, Defx Perps DEX requires pre-launch verification, while Curve enforces strict balance ratios. To ensure sustainable liquidity management, focus on:

- Community Engagement: Build trust and loyalty through clear communication and well-designed incentives.

- Supply Management: Use gradual token unlocks and strategic buybacks to avoid sudden price drops.

Each DEX has its own unique features. Platforms like Defx Perps DEX, for instance, offer isolated and cross-margin trading, which demand tailored liquidity strategies. Understanding these platform-specific requirements is key to crafting an effective approach.

Regularly revisiting and refining your liquidity strategy is essential for long-term success. This not only stabilizes trading activity but also supports organic token growth. By combining these strategies with platform-specific adjustments, projects can establish a strong presence in the decentralized trading ecosystem.

FAQs

How does liquidity work on Dex?

DEXs rely on liquidity pools to enable trading through automated market making. These pools consist of token pairs locked in smart contracts. Here’s how the system operates:

| Component | Function | Benefit |

|---|---|---|

| Trading Fees | A small percentage charged per swap | Provides revenue to liquidity providers |

| Liquidity Pool | Token pairs locked in smart contracts | Powers automated market making |

| Incentives | Rewards beyond trading fees | Encourages and retains liquidity providers |

Liquidity providers earn trading fees (usually 0.2-0.3% per trade) and may also receive extra rewards, such as yield farming incentives, for contributing token pairs to these pools. In exchange, they are issued LP tokens, which represent their share of the pool.

For new tokens, maintaining sufficient liquidity is critical. Projects are advised to keep pools at least double their daily trading volume. This helps reduce price slippage and ensures smooth trading activity.

Platforms like Defx Perps DEX take things further by offering features like isolated and cross-margin trading. These tools add flexibility while ensuring security through non-custodial trading options.

However, providing liquidity isn’t without risks. One major concern is impermanent loss, which can impact profits. To succeed, it’s essential to understand the platform’s specific requirements and develop strategies to optimize liquidity contributions.