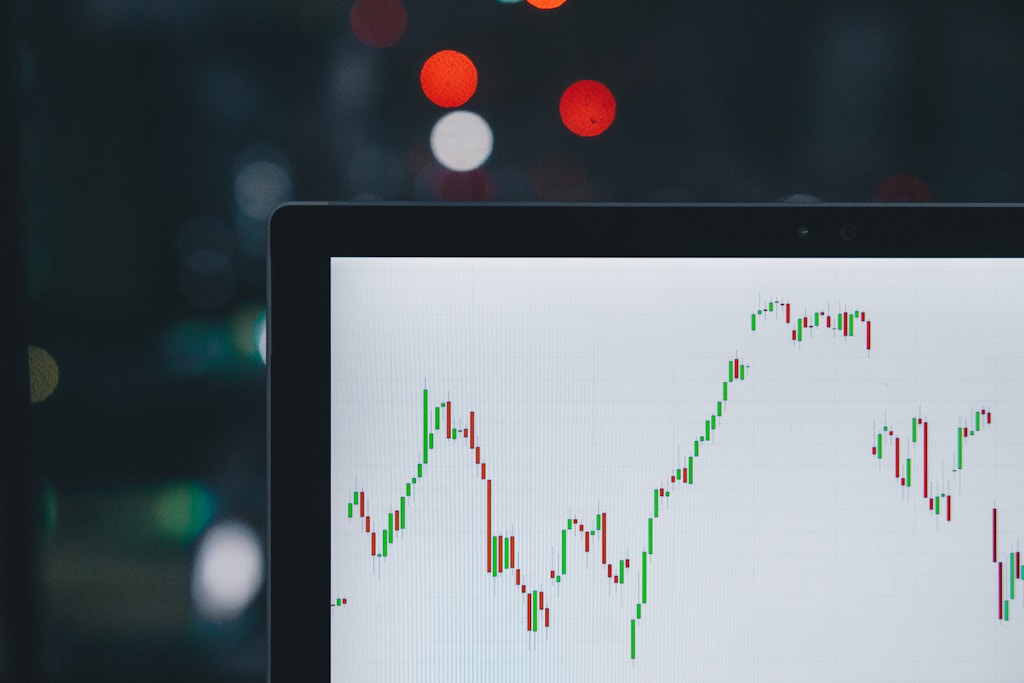

Market Alert: Uniswap Approaches Decisive Technical Level

Uniswap (UNI) is approaching a critical technical threshold that could determine its next major price movement. The leading DEX token is testing its 100-day Simple Moving Average (SMA), a level that historically acts as a powerful support and resistance zone. Technical analysis suggests this could be a pivotal moment for UNI, with significant implications for both short and medium-term price action.

Similar to the recent dramatic moves in PancakeSwap, this technical setup could signal a major shift in DeFi token momentum.

Technical Analysis Deep Dive

Key technical indicators paint an increasingly bullish picture for UNI:

- MACD has crossed above the signal line

- Trading volume shows significant increase

- Price action forming a potential bull flag pattern

- RSI indicating oversold conditions

The 100-day SMA, currently at approximately $6.20, represents a crucial battleground between bulls and bears. A decisive break above this level could trigger a cascade of buy orders, potentially pushing UNI toward the following key resistance levels:

- First resistance: $6.70

- Secondary target: $7.50

- Major resistance: $8.70

Market Implications and Trading Scenarios

Two primary scenarios are emerging:

Bullish Case: A break above the 100-day SMA with strong volume could initiate a rally targeting $8.70, representing a potential 60% gain from current levels. This move would likely be supported by broader DeFi market momentum and increased institutional interest.

Bearish Case: Rejection at the current level could lead to a retest of support at $5.50. A break below this level might trigger a deeper correction toward the $4.80 range.

Market Context and Volume Analysis

Trading volume has seen a notable 45% increase over the past 24 hours, suggesting growing market interest in UNI’s price action. Institutional flows data indicates accumulation by larger players, potentially setting the stage for a significant move.

Expert Perspectives

Leading crypto analyst Sarah Chen notes: “The current technical setup for UNI mirrors patterns we’ve seen before major rallies. The combination of increased volume and positive MACD divergence suggests strong potential for upward movement.”

Risk Factors and Considerations

Traders should consider several risk factors:

- Overall crypto market volatility

- DeFi sector-specific risks

- Regulatory developments

- General market liquidity conditions

Conclusion and Outlook

As Uniswap approaches this critical technical level, the next 48-72 hours could prove decisive for its price trajectory. The confluence of technical indicators and increasing volume suggests a major move is imminent. Traders should maintain strict risk management practices while monitoring key support and resistance levels.