Bitcoin Trapped at $83K: Critical Fed Decision Looms

Bitcoin struggles at $83K-$84K resistance as markets await Federal Reserve decision. Analysts divided on next move with key support at $80K and resistance at…

Market Overview

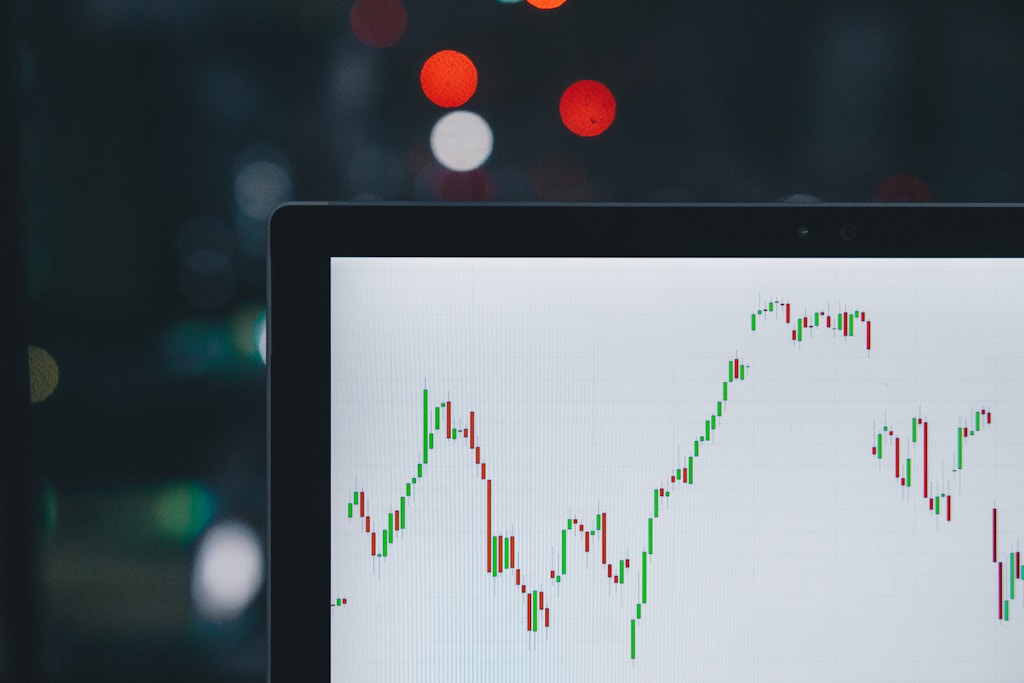

Bitcoin continues to face strong resistance between $83,000-$84,000 as macroeconomic uncertainty and geopolitical tensions weigh on investor sentiment. The leading cryptocurrency has declined over 29% from its January all-time high of $109,000, with analysts divided on the next major move. Today’s Federal Reserve meeting could provide the catalyst needed to break the current deadlock.

Technical Analysis

According to prominent crypto analyst Jelle, Bitcoin has found a temporary equilibrium in the $83K-$84K range, with bears unable to push prices significantly lower while bulls struggle to break higher resistance levels. The cryptocurrency currently trades below both the 200-day moving average and exponential moving average, suggesting continued bearish pressure.

Key Price Levels to Watch

- Resistance: $84,000-$86,000

- Support: $80,000

- Critical Breakout Level: $90,000

Market Catalysts

The Federal Reserve’s interest rate decision today stands as the primary catalyst that could determine Bitcoin’s next directional move. A hawkish stance suggesting higher rates for longer could trigger further selling pressure, while a dovish pivot might fuel a recovery above $85,000.

Market Implications

If Bitcoin fails to maintain support at $80,000, technical analysts suggest a potential decline toward the mid-$70,000 range. Conversely, a break above $90,000 would invalidate the current bearish structure and potentially trigger a strong recovery rally.

Expert Outlook

Market experts emphasize the importance of today’s Fed decision in determining short-term price action. The combination of technical resistance and macroeconomic uncertainty suggests Bitcoin may remain range-bound until a clear catalyst emerges.