Binance KYC tutorial

Understand the KYC process on a leading cryptocurrency exchange to ensure secure trading and unlock advanced features.

Binance‘s Know Your Customer (KYC) process is essential for secure cryptocurrency trading and regulatory compliance. Completing KYC unlocks advanced trading features and higher account limits. Here’s a quick overview:

Why KYC Matters:

- Prevents fraud and money laundering

- Enables full trading access

- Increases withdrawal and deposit limits

- Improves account security

Required Documents:

- Government-issued ID: Passport, National ID, or Driver’s License

- Proof of Address (for higher levels): Utility bill, bank statement, or tax document (issued within 3 months)

Steps to Complete KYC:

- Access Verification: Navigate to the "Identification" section on Binance’s website or app.

- Enter Personal Details: Match your ID exactly.

- Upload Documents: Ensure clear, high-quality images.

- Face Verification: Follow on-screen instructions in a well-lit area.

Common Issues and Fixes:

- Mismatch in Details: Double-check your information.

- Blurred Photos: Retake images with good lighting.

- Verification Delays: Allow up to 48 hours for processing.

Completing Binance KYC ensures better security, higher limits, and access to all trading features. Follow the steps carefully for a smooth experience.

How to Complete Identity Verification(KYC) on Binance

Required Items for KYC

Make sure to gather all necessary documents before starting the Binance KYC process to avoid any delays.

Document Checklist

Here’s what you’ll need:

| Document Type | Accepted Forms |

|---|---|

| Primary ID | – Valid Passport – National ID Card – Driver’s License |

| Proof of Address* | – Recent Utility Bills – Bank Statements – Tax Documents |

*Proof of address is required for Level 2 verification and must be dated within the last 3 months .

Once you’ve gathered these, ensure they meet the quality guidelines below to avoid any issues during verification.

Document Quality Guidelines

- Validity: Make sure your ID is current and matches the details on your Binance account . Proof of address documents must be issued within the last 3 months .

- Image Clarity: Upload clear, high-resolution images where all details are easy to read .

For Level 2 verification, you’ll need both a government-issued ID and proof of address. This level unlocks full platform access and higher withdrawal limits . Keep in mind, non-government-issued IDs are not accepted for this process . Following these steps will help ensure a smooth verification experience.

KYC Steps on Binance

To successfully complete your Binance KYC verification, follow these steps on either the desktop website or mobile app.

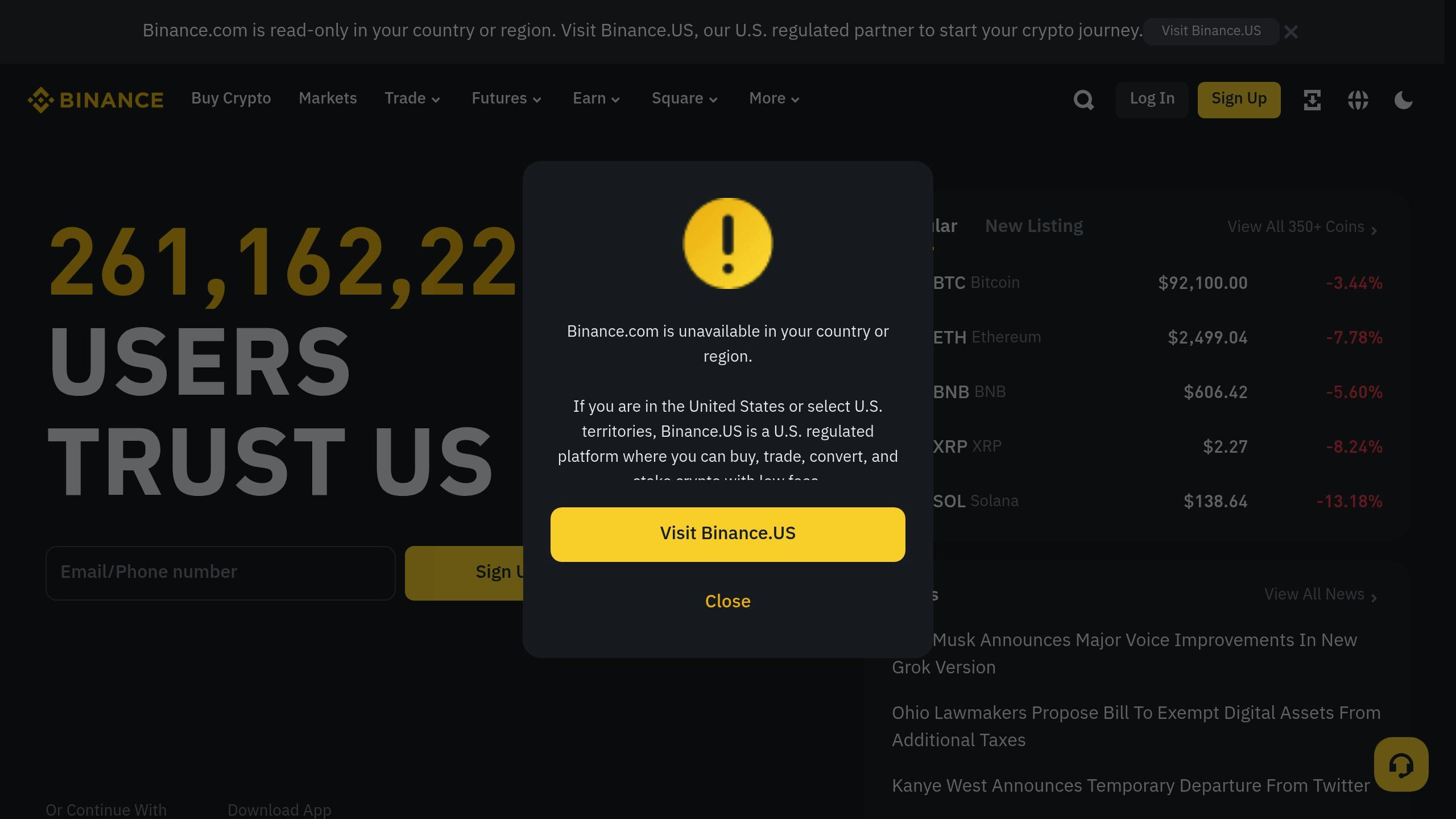

Finding the KYC Section

On the Binance website, you can access the verification section by:

- Clicking [Account] in the top navigation.

- Selecting [Identification] from the dropdown menu.

- Alternatively, clicking [Verify] or [Get Verified] from any homepage banner.

On the Binance mobile app, locate the verification area by:

- Tapping [Account Center].

- Looking for the [Unverified] status.

- Or tapping [Verify Now] directly from the app homepage.

Make sure to enter your personal details exactly as they appear on your official documents.

Personal Data Entry

Choose your country and input your personal information exactly as shown on your official documents. Once submitted, this information cannot be changed.

| Data Entry Tips | Why It Matters |

|---|---|

| Match Name Exactly | Must align perfectly with your ID document |

| Use Current Address | Should match your proof of address |

| Accurate Birth Date | Must match your ID documentation |

| Correct Document Numbers | Enter them exactly as shown on your ID |

Double-check everything before clicking ‘Continue’ to avoid processing delays.

ID Document Upload

-

Choose Document Type

Select the appropriate document based on your country’s requirements, such as:- Passport

- National ID card (front and back required)

- Driver’s license

-

Capture the Document

Tips for a clear upload:- Enable camera access and ensure the full document is visible.

- Make sure all text is clear and readable.

- Avoid glare or shadows that could obscure information.

Face Verification Steps

For face verification, follow these guidelines:

- Position your face in the center of the frame in a well-lit area.

- Avoid wearing hats, glasses, or applying filters.

- Keep your eyes open and follow the on-screen movement instructions.

- Hold still until the process finishes.

Important: Do not refresh or close the app or browser while the verification is in progress.

sbb-itb-dd9e24a

Fix Common KYC Problems

Having trouble with KYC verification? Here’s how to address the most frequent issues.

Failed Verification Fixes

If your verification is rejected, it’s usually because of one of these reasons:

| Issue | Solution |

|---|---|

| Information Mismatch | Double-check that your details match your ID exactly. |

| Expired Documents | Use only valid, up-to-date documents. |

| Poor Image Quality | Take clear photos in good lighting, ensuring the entire document is visible. |

| Failed Face Verification | Follow the face verification steps carefully and ensure proper setup . |

You have up to 10 attempts per day . If problems persist, try these tips:

- Retake photos against a dark background, ensuring all corners and text are visible .

- Remove accessories and ensure good lighting during face verification .

- Verify that your uploaded documents are clear, current, and match your account details .

Document Upload Issues

Sometimes, even with accurate details, the problem lies in uploading your documents.

- Technical Issues: If the website upload isn’t working, try using the Binance mobile app instead .

- Processing Delays: Verifications typically take up to 48 hours, but during busy periods, it may take longer. Keep an eye on your email for updates or additional requests .

- Image Requirements: Make sure your uploads meet the quality standards mentioned earlier .

If you’ve tried everything and still face issues, reach out to Binance support for help . Keep in mind that stricter verification standards are now in place due to regulatory requirements .

After KYC Completion

Once you’ve completed KYC (Know Your Customer) verification, your account gets access to higher limits and expanded trading options. With verification hurdles out of the way, you can now enjoy enhanced features and tailored account capabilities.

New Account Limits

Your account’s limits depend on your verification level:

| Feature | Verified Level | Verified Plus Level |

|---|---|---|

| Monthly Fiat Deposits | $5,000 | $15,000 |

| Monthly Fiat Withdrawals | $10,000 | $30,000 |

If you want even higher limits, upgrading to Verified Plus requires providing extra proof of address .

Available Trading Features

Basic Features:

- Access to Binance promotions

- Staking opportunities

Advanced Features:

- Bank transfer (ACH) deposits and withdrawals

- Spot trading options

- Auto-Buy cryptocurrency features

- API trading access

Without completing KYC, users face limitations on withdrawals, order cancellations, position closures, and redeeming assets .

Binance offers multiple verification levels (from Level 0 to Level 4), with each step unlocking more features and higher limits . Certain services, like the Binance Card, require specific KYC levels to access .

Summary

Complete Binance KYC verification to gain full trading access and improve account security. Here’s a quick overview of the key steps and details mentioned earlier.

Main Points

Binance KYC ensures user protection and compliance with regulations. Here’s what you need to know:

| Aspect | Details |

|---|---|

| Required Documents | Government-issued ID and recent proof of address |

| Processing Time | Typically reviewed within 48 hours |

| Security Benefits | Helps prevent fraud, corruption, money laundering, and terrorist financing |

| Trading Access | Enables full crypto deposits, exchanges, and withdrawals |

Tips for a smooth verification process:

- Ensure your personal details match exactly with your ID.

- Upload clear, well-lit photos (no filters).

- Remove accessories during the facial verification step.

- Use a stable internet connection.

Higher verification tiers offer additional features and increased limits . This layered system enhances security while adhering to regulatory requirements.