How AMM Algorithms Use On-Chain Data

Explore how Automated Market Makers utilize on-chain data for decentralized trading, price calculations, and liquidity management.

Automated Market Makers (AMMs) rely on on-chain data to enable decentralized trading, calculate prices, and manage liquidity in real-time. Unlike traditional exchanges, AMMs use mathematical formulas and blockchain transparency to ensure efficient, instant trades without needing a direct counterparty. Here’s how on-chain data powers AMMs:

- Live Market Data: Tracks pool reserves, token ratios, and slippage for accurate pricing and smooth operations.

- Past Transaction Data: Helps refine strategies, manage risks, and optimize liquidity allocations based on trading volume, price trends, and user behavior.

- Price Oracle Data: Validates internal pricing models using external data to prevent arbitrage and align prices across chains.

Platforms like Uniswap, Curve Finance, and Defx Perps DEX utilize these data types uniquely to improve capital efficiency, reduce risks, and enhance user experience. The future of AMMs includes advancements like Layer 2 solutions for faster processing, machine learning for liquidity optimization, and hybrid models combining AMMs with order books.

What Are Automated Market Makers?

Key On-Chain Data Types for AMMs

Blockchain plays a key role in price discovery and risk management, and three types of data are especially important for Automated Market Makers (AMMs):

Live Market Data

Live market data fuels the essential operations of AMMs by offering up-to-the-minute insights into pool conditions and trading activity. This includes details like current pool reserves, token ratios, and slippage metrics, all of which are crucial for calculating exchange rates.

Take Uniswap V3 as an example: it processes 2-3 million on-chain data points every day, just for managing liquidity [2]. This constant flow of data allows AMMs to:

- Estimate trade slippage

- Track liquidity depth across price ranges

- Adjust fees dynamically based on market volatility

While real-time data ensures smooth day-to-day operations, historical data provides the foundation for long-term planning.

Past Transaction Data

Historical transaction data allows AMMs to refine their strategies and anticipate market movements. Below is a breakdown of how this data is applied:

| Metric | Application | Outcome |

|---|---|---|

| Trading Volume | Identify popular pairs | Optimize liquidity allocation |

| Price Trends | Track market direction | Adjust risk settings |

| Gas Fees | Monitor network costs | Improve transaction timing |

| User Patterns | Analyze behavior | Enhance user experience |

"By analyzing past instances of impermanent loss, AMMs can develop better risk management strategies and implement more effective protective measures for liquidity providers" [5].

Price Oracle Data

Price oracle data acts as an external checkpoint, helping AMMs validate their internal pricing models. For instance, Chainlink Price Feeds – a leading oracle provider – delivered over 2.6 billion on-chain price updates in 2022 [6], showcasing the scale of its role in decentralized finance.

AMMs rely on oracle data for tasks such as:

- Comparing internal prices with external market rates

- Spotting arbitrage opportunities

- Aligning prices across chains

- Supporting derivative instruments

Platforms like Uniswap V3 enhance accuracy by combining multiple oracle sources with TWAP (Time-Weighted Average Price) calculations [2][6]. This ensures pricing remains reliable and consistent.

sbb-itb-dd9e24a

AMM Data Processing Methods

AMMs rely on real-time and historical data streams to keep markets running smoothly. They use three main techniques to achieve this.

Pool Balance Updates

Smart contracts automatically adjust token ratios after every trade. This ensures prices stay balanced by continuously monitoring reserves and using oracle-verified data for updates.

These quick recalculations are a key reason why modern platforms achieve higher capital efficiency.

Market-Based Fee Changes

To respond to market conditions, many AMMs use dynamic fee structures. These fees adjust automatically based on factors like trading volume, price swings, and liquidity levels. The system analyzes data constantly to make these adjustments.

Loss Prevention Methods

To reduce impermanent loss, AMMs use historical data analysis. For example, Balancer optimizes its pools by studying past performance. It uses on-chain data to review price changes and volatility trends, adjusting token weights to improve returns [8].

Key areas of analysis include:

- Price range and volatility trends

- Historical asset correlations

AMM Platform Examples

Different platforms use these data processing techniques in unique ways, tailoring them to specific trading needs.

Defx Perps DEX Analysis

Defx takes advantage of Solana‘s high-speed capabilities to handle margin calculations in real time. Its system continuously monitors positions, enhancing its margin features. Building on earlier risk management principles, Defx focuses on:

- Calculating accurate margin requirements and liquidation thresholds

- Assessing new token viability by analyzing liquidity depth

- Supporting fast, low-latency order execution

This real-time strategy sets Defx apart from Uniswap, which uses historical data to improve capital efficiency.

Uniswap V3 Methods

Uniswap V3 is known for being up to 4000x more capital-efficient than its earlier version [1]. Its data processing framework includes:

- Flexible fee adjustments (0.05%, 0.3%, and 1%) based on trading volume

- Incorporating TWAP oracle principles for pricing

- Liquidity Distribution: Concentrating liquidity to optimize swap routing

A standout example is the ETH/USDC 0.3% pool, which generated nearly 30x more fees per dollar of TVL compared to V2 pools [1].

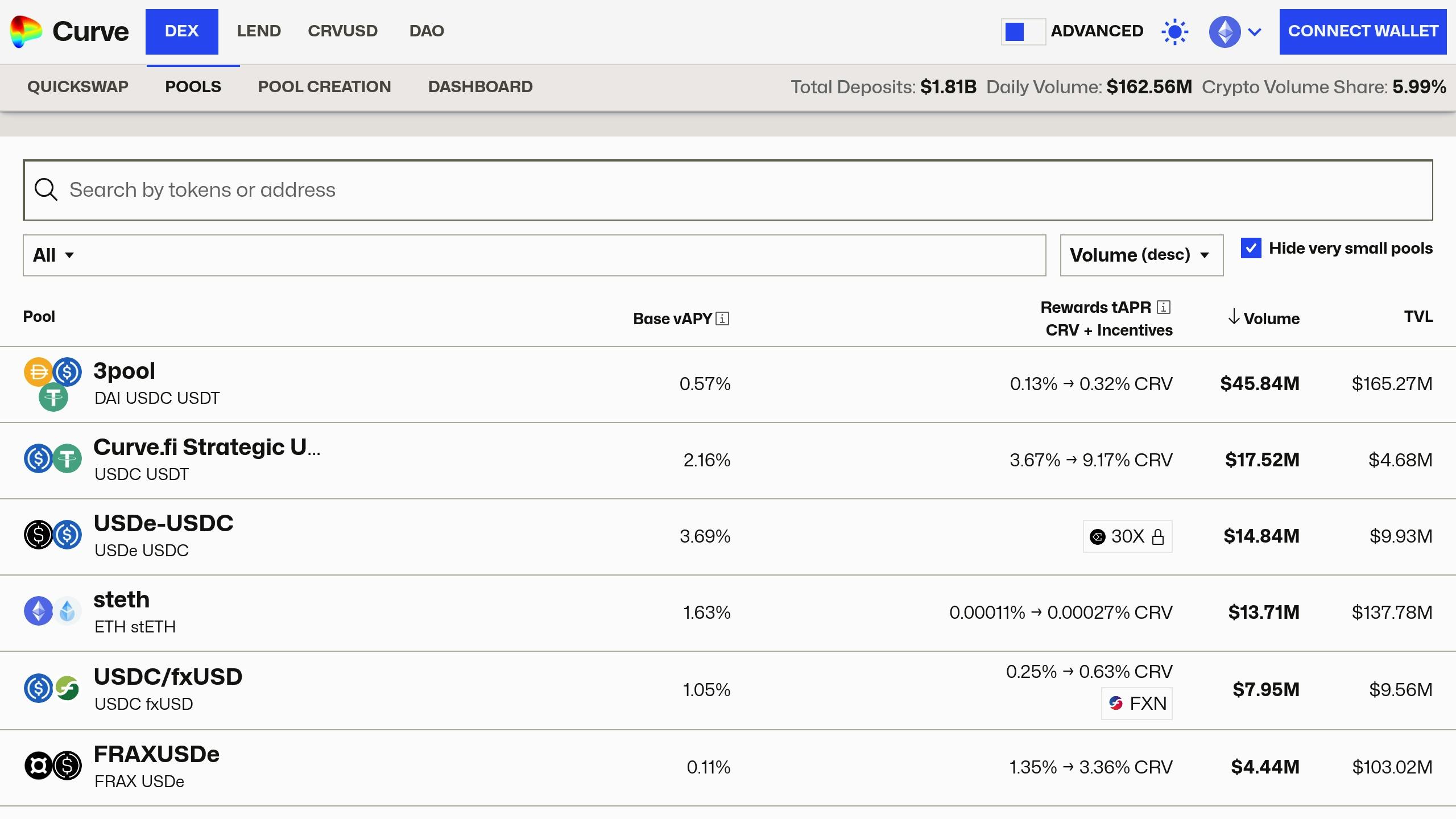

Curve Finance Approach

Curve Finance, designed for stablecoin trading, prioritizes maintaining price stability. By applying impermanent loss prevention techniques, the platform can handle trades as large as $100M with slippage under 0.1% [4]. Key strategies include:

- Adjusting bonding curves using liquidity data to keep stablecoin pegs intact

- Slippage Protection: Reducing the impact of large trades on price

This approach proved effective in Q3 2022 when Curve’s 3pool (DAI/USDC/USDT) processed over $20 billion in volume with an average slippage of just 0.02% [4].

Looking Ahead: AMMs and Blockchain Data

Three key trends are shaping the future of AMMs, building on current data processing methods:

- Layer 2 solutions like zk-Rollups are improving the speed of live market data processing while cutting gas costs. This makes it easier for AMMs to handle live data streams efficiently [9].

- Machine learning models are now being used to study cross-chain liquidity patterns. These models help optimize real-time allocations by analyzing pool balance data, as mentioned earlier [7]. At the same time, privacy-preserving tools like zero-knowledge proofs are gaining ground. These tools strike a balance between keeping user data private and maintaining the on-chain transparency needed for accurate price discovery [2].

- Hybrid models are emerging, blending AMM liquidity pools with order book depth indicators. This offers traders more flexibility. A good example is Defx’s dual-chain architecture, which extends real-time margin calculations across multiple networks [3].

Additionally, more detailed blockchain data analysis is set to improve risk management and capital efficiency across decentralized trading platforms [1]. These advancements are happening alongside the ongoing growth of DeFi, showing how the space continues to evolve and adapt.