Polymarket and an introduction to Crypto prediction markets

Explore the mechanics, benefits, and challenges of decentralized prediction markets, focusing on how they reshape forecasting in various domains.

Crypto prediction markets, like Polymarket, let users trade tokens based on event outcomes, combining blockchain with forecasting. These platforms are part of the decentralized finance (DeFi) ecosystem, offering real-time probability estimates through crowd-driven trading.

Key Takeaways:

- How It Works: Users trade tokens (priced $0–$1) tied to "Yes" or "No" outcomes. Prices reflect the likelihood of events.

- Core Features: Powered by smart contracts, oracles for event verification, and low-cost blockchain networks like Polygon.

- Popular Markets: Include politics, cryptocurrency prices, sports, and entertainment.

- Advantages: Decentralized platforms like Polymarket offer transparency, global access, and lower costs compared to centralized options.

- Challenges: Regulatory hurdles, data feed security, and market volatility remain key risks.

Quick Comparison: Centralized vs. Decentralized Prediction Markets

| Feature | Centralized Markets | Decentralized Markets |

|---|---|---|

| Control | Managed by a single entity | Blockchain-based governance |

| Verification | Internal teams | Oracle systems (e.g., UMA) |

| Costs | Fixed platform fees | Gas fees + platform fees |

| Access | Region-restricted | Open, global participation |

Polymarket stands out for its user-friendly design, low transaction costs, and diverse market options. However, users should be aware of risks like price swings and regulatory restrictions while exploring this growing space.

Crypto Prediction Markets Explained

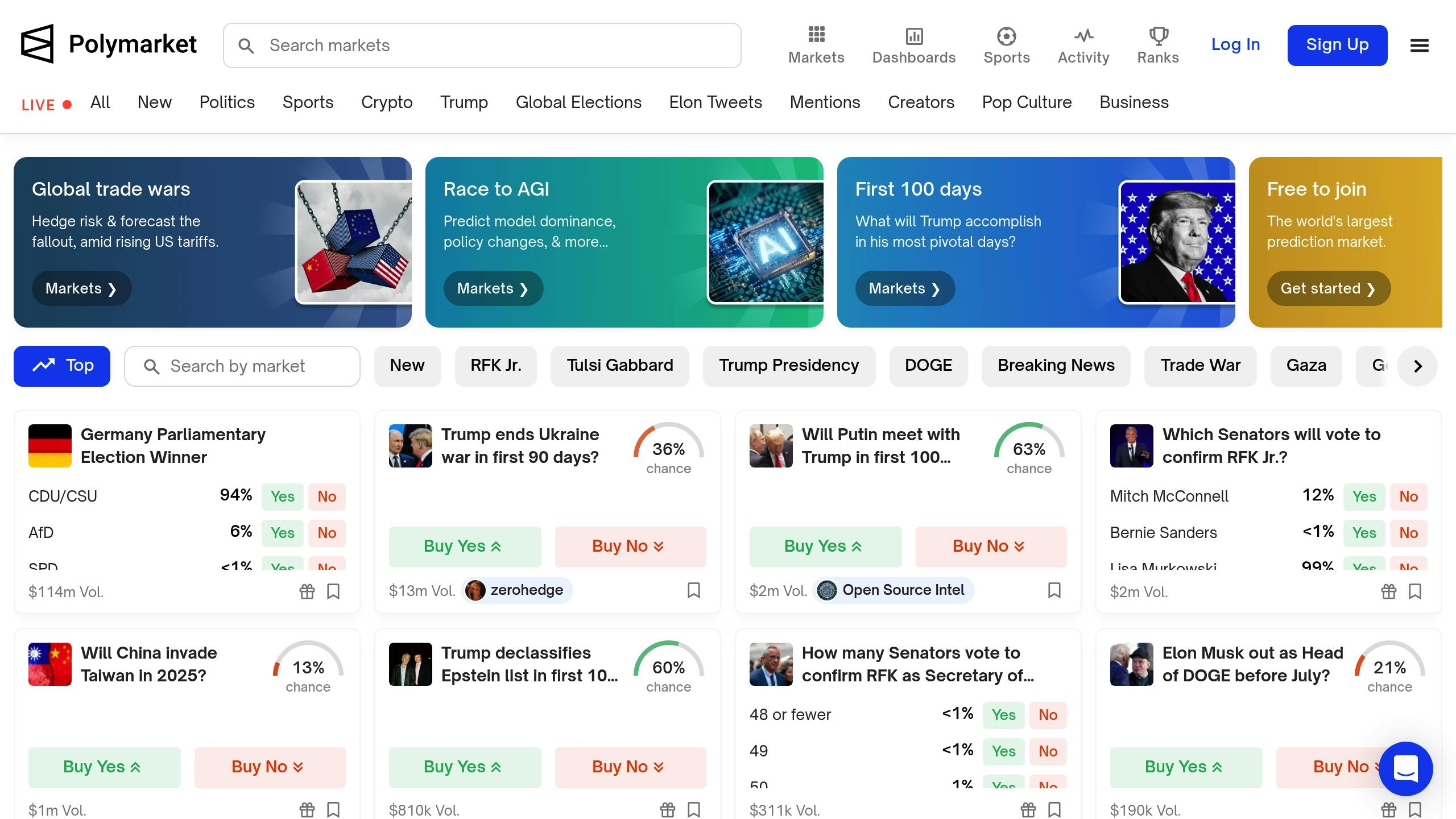

Polymarket Platform Overview

Polymarket has established itself as a leading player in blockchain-based prediction markets, offering a unique approach to decentralized trading. By combining event derivatives with the principles of DeFi, Polymarket makes it possible to trade on the outcomes of real-world events.

How Polymarket Works

Polymarket operates as a decentralized platform for trading event derivatives, running on the Polygon network. This setup ensures low transaction costs while maintaining a seamless trading experience. All transactions on the platform are conducted in USDC (USD Coin), benefiting from Polygon’s reduced fees compared to Ethereum’s main network [1]. The use of ERC-1155 tokens allows users to participate in markets with greater flexibility, aligning with the broader concept of tokenization.

Here are some of the platform’s key technical features:

| Component | Details |

|---|---|

| Oracle System | Universal Market Access (UMA) |

| Token Standard | ERC-1155 on Polygon |

Market Types on Polymarket

Polymarket provides a variety of market categories, enabling users to trade on binary outcomes tied to real-world events. These markets use USDC for transactions, offering a fresh angle to traditional crypto trading strategies. Popular market categories include:

- Political elections

- Economic indicators

- Sports outcomes

- Entertainment events

- Financial metrics

One standout example is the "Presidential Election Winner 2024" market, which saw exceptional activity. As of July 12, 2024, this market recorded nearly $250 million in bets [4].

Platform Usage Stats

Polymarket’s growth has been impressive, with data from October 2024 showcasing its expanding reach and user engagement:

| Metric | Value | Trend |

|---|---|---|

| Monthly Trading Volume | $2 billion | Increasing |

| Active Traders | 191,000+ | Steady growth |

| Daily Active Users | 30,000+ | Record high |

| Open Interest | $46 million | Growing |

June 2024 alone saw the platform attract 29,432 new users, maintaining an average of 3,590 daily active traders [4]. These figures highlight Polymarket’s growing influence in the decentralized prediction market landscape.

Centralized vs Decentralized Markets

Control and Verification Methods

The main distinction between centralized and decentralized prediction markets lies in how they are governed. Centralized platforms are managed by a single entity, while decentralized ones rely on blockchain and smart contracts.

Centralized platforms typically use internal teams to verify outcomes. In contrast, decentralized markets rely on blockchain-based oracle systems. For example, Polymarket uses the Universal Market Access (UMA) oracle system to ensure transparent and tamper-proof outcome verification [2]. This system builds on Polymarket’s earlier technical infrastructure, creating a system where market resolutions don’t require trust in a central authority.

Advantages of Decentralized Markets

Decentralized prediction markets bring several benefits that align with the principles of decentralized finance (DeFi). These include improved security, open access across the globe, and lower costs by cutting out intermediaries.

| Benefit | Description | Impact |

|---|---|---|

| Self-Custody | Users maintain direct control of assets | Lowers counterparty risks |

| Censorship Resistance | Operates without central authority control | Ensures market stability |

| Global Access | No location-based restrictions | Encourages diverse participation |

| Transparency | Blockchain records all transactions | Builds trust and verification |

Comparing Platforms

The way centralized and decentralized prediction markets operate affects both user experience and platform functionality. Here’s a closer look at the differences:

| Feature | Centralized Markets | Decentralized Markets |

|---|---|---|

| Transaction Speed | Fast, near-instant settlements | Dependent on blockchain speed |

| Cost Structure | Fixed platform fees | Includes gas fees and platform fees |

| Market Creation | Controlled by the platform, traditional web | User-driven, requires Web3 wallets |

| Dispute Resolution | Managed by internal support teams | Automated through smart contracts |

Platforms like Polymarket have tackled scalability issues by leveraging Polygon’s Layer 2 solution. This approach allows Polymarket to handle large transaction volumes efficiently, proving that decentralized models can work effectively for large-scale prediction markets [2].

sbb-itb-dd9e24a

Common Market Applications

Prediction markets are gaining traction through several practical uses that showcase their usefulness in everyday scenarios.

Crypto Price Predictions

One of the most active areas on Polymarket is cryptocurrency price prediction markets. These focus on specific price benchmarks or comparing the performance of different cryptocurrencies. For example, markets such as "Will Bitcoin reach $100,000 by December 31, 2025?" or "Will Ethereum outperform Bitcoin in Q1 2026?" are popular choices [2]. The pricing in these markets shifts dynamically, reflecting real-time sentiment as users buy shares tied to "Yes" or "No" outcomes.

Election and Policy Markets

Political prediction markets have shown a strong track record in accurately forecasting election results [4]. Beyond elections, policy-related markets tackle a range of topics:

| Market Type | Examples | Purpose |

|---|---|---|

| Legislative Outcomes | Carbon tax implementation by 2027 | Anticipating policy shifts |

| Environmental Goals | EU 2030 emissions targets | Tracking progress |

| Regulatory Decisions | Crypto regulation changes | Analyzing policy impact |

These markets are valuable for policymakers and analysts, offering measurable insights into likely outcomes and aiding in informed decision-making [1].

Business Use Cases

Prediction markets have also found a place in corporate settings, where companies use them for internal forecasting and planning. For example, Google has adopted this approach to predict outcomes like:

"Google has used prediction markets to forecast product launch dates, project completion times, and even office openings. These markets allow employees to ‘bet’ on various outcomes, leveraging the collective intelligence of the organization" [6].

Hewlett-Packard has similarly used employee-driven prediction markets with virtual currency incentives to refine sales forecasts. This approach taps into frontline insights, helping identify potential risks early [6].

In addition to these traditional uses, prediction markets also play a role in technological forecasting, offering insights into adoption trends and timelines for emerging technologies. These predictions guide resource allocation and investment strategies [1]. Platforms like Polymarket take this concept further by enabling decentralized participation through blockchain, opening access to a broader audience [1].

Risks and Problems

The rise of crypto prediction markets comes with a set of challenges that both users and platforms need to address. Being aware of these risks is key to navigating this space safely.

Data Feed Security

One major issue is ensuring the reliability of data feeds. Platforms like Polymarket depend on oracle systems to resolve markets, which introduces potential vulnerabilities. If these systems fail or are compromised, users could face irreversible financial losses. Polymarket, for instance, uses a UMA-based system, making it clear that strong security protocols are a must.

Current measures to address these vulnerabilities include:

| Measure | Purpose |

|---|---|

| Reputation Systems | Tracks oracle reliability |

| Cryptographic Proofs | Ensures data accuracy |

| Cross-Chain Solutions | Enables multi-blockchain use |

Legal Status

Regulatory issues also pose a major challenge for crypto prediction markets. In January 2022, Polymarket faced a $1.4 million penalty from the CFTC for running an unregistered market [3]. This enforcement action occurred during a period of rapid growth for the platform and led to restricted access for U.S. users and the adoption of stricter KYC procedures.

These regulatory shifts create several operational hurdles for platforms, including:

- Limited market access in certain regions

- Higher compliance costs

- Restrictions on the types of markets offered

- Navigating complex and varying legal frameworks

Price Swings and Risk

Even with secure systems and regulatory compliance, the inherent volatility of these markets remains a concern. Unlike traditional financial markets, crypto prediction platforms lack mechanisms like circuit breakers to manage extreme price changes. For example, during the 2022 crypto market crash, many platforms faced severe liquidity issues and wild price swings [6].

Some markets have seen daily price fluctuations exceeding 200% [5]. This level of volatility is especially problematic for long-term predictions, where numerous factors can shift over time. To address this, some platforms are exploring options-like structures to help limit potential losses.

What’s Next for Prediction Markets

Prediction markets are evolving quickly, with the sector expected to hit $14.8 billion by 2026 [2]. Advances in technology and growing interest from institutions are driving this growth, creating opportunities for platforms like Polymarket and its emerging competitors.

New Platforms and Features

New players like Augur v2 and Gnosis are bringing fresh tools and approaches to the table, complementing Polymarket’s focus on accessibility:

| Platform | Key Features | Target Market |

|---|---|---|

| Augur v2 | Smart contract automation | Advanced traders |

| Gnosis | Developer tools, custom markets | Platform builders |

| Polymarket | Easy-to-use interface | Everyday users |

Technical Updates

Recent upgrades are tackling past security issues while enabling broader use cases. Enhanced data verification systems and cross-chain compatibility are improving reliability and expanding application possibilities.

Growing Institutional Interest

Institutional players are starting to see the value of prediction markets for applications like risk management and decision-making. This growing interest boosts Polymarket’s appeal.

"The integration of prediction markets with other DeFi protocols is opening up exciting possibilities for new financial products. Prediction market outcomes could be used as triggers for decentralized insurance products, allowing for more dynamic and responsive coverage" [7].

Corporate adoption is taking shape through:

- Integration with DeFi-based insurance products

- Advanced risk modeling for institutions

- Automated tools for supply chain forecasting

The combination of better technology, institutional backing, and regulatory developments signals a major shift for crypto prediction markets. Polymarket is well-positioned to bridge decentralized speculation with traditional financial strategies.

Summary

Main Points

Polymarket leads the decentralized prediction market space, offering high trading volumes and a wide range of event topics. These markets rely on crowd-sourced insights, decentralized access, and integration with DeFi protocols.

Polymarket’s Position

Polymarket’s dominance is built on three key strengths:

- Efficient Infrastructure: Uses Layer 2 technology and an oracle system via Polygon, balancing costs and security.

- Accessible Design: A user-friendly platform that attracts large liquidity pools.

- Varied Market Options: Covers a broad spectrum of sectors and topics.

Although facing regulatory hurdles, Polymarket continues to grow by advancing its technology and appealing to institutional users. This approach helps it connect speculative trading with professional forecasting tools while adhering to compliance standards and improving decentralized forecasting systems.