The Block Review

Explore the leading decentralized leverage trading platforms, comparing features, fees, and strengths to find the ideal fit for your trading style.

Decentralized leverage trading platforms are reshaping crypto markets by giving users full control over their funds and trading activities. Here’s a quick breakdown of the top platforms covered in this review:

- GMX: Offers up to 50x leverage with a focus on security and predictable fees. Limited asset options.

- dYdX: Supports 193+ markets with up to 20x leverage and rewards high-volume traders with low fees.

- Vela Exchange: Provides high leverage (up to 100x for forex) and advanced risk management tools. Best for experienced traders.

- Defx: Operates on Ethereum and Solana, offering up to 50x leverage and a tiered fee structure that rewards active users.

Quick Comparison Table

| Feature | GMX | dYdX | Vela Exchange | Defx |

|---|---|---|---|---|

| Max Leverage | 50x | 20x | 30x (crypto), 100x (forex) | 50x |

| Trading Fees | 0.05–0.07% | 0–0.05% | Tiered | Tiered |

| Key Strength | Security focus | Volume incentives | High leverage | Multi-chain support |

| Primary Limitation | Limited assets | Declining TVL | Complex for beginners | Network dependence |

Key Takeaways

- For Security: GMX is ideal with its robust safety measures and user-friendly fees.

- For Active Traders: dYdX offers volume-based discounts and a wide range of markets.

- For High Leverage: Vela Exchange is best suited for experienced traders seeking higher risk/reward.

- For Flexibility: Defx’s dual-network setup supports diverse trading strategies.

This comparison helps you quickly identify the platform that aligns with your trading priorities. Dive into the full article for detailed insights into each platform’s features, fees, and strengths.

Best Decentralized Crypto Exchanges – GMX, APEX, MUX, ApolloX, dYdX, Vela

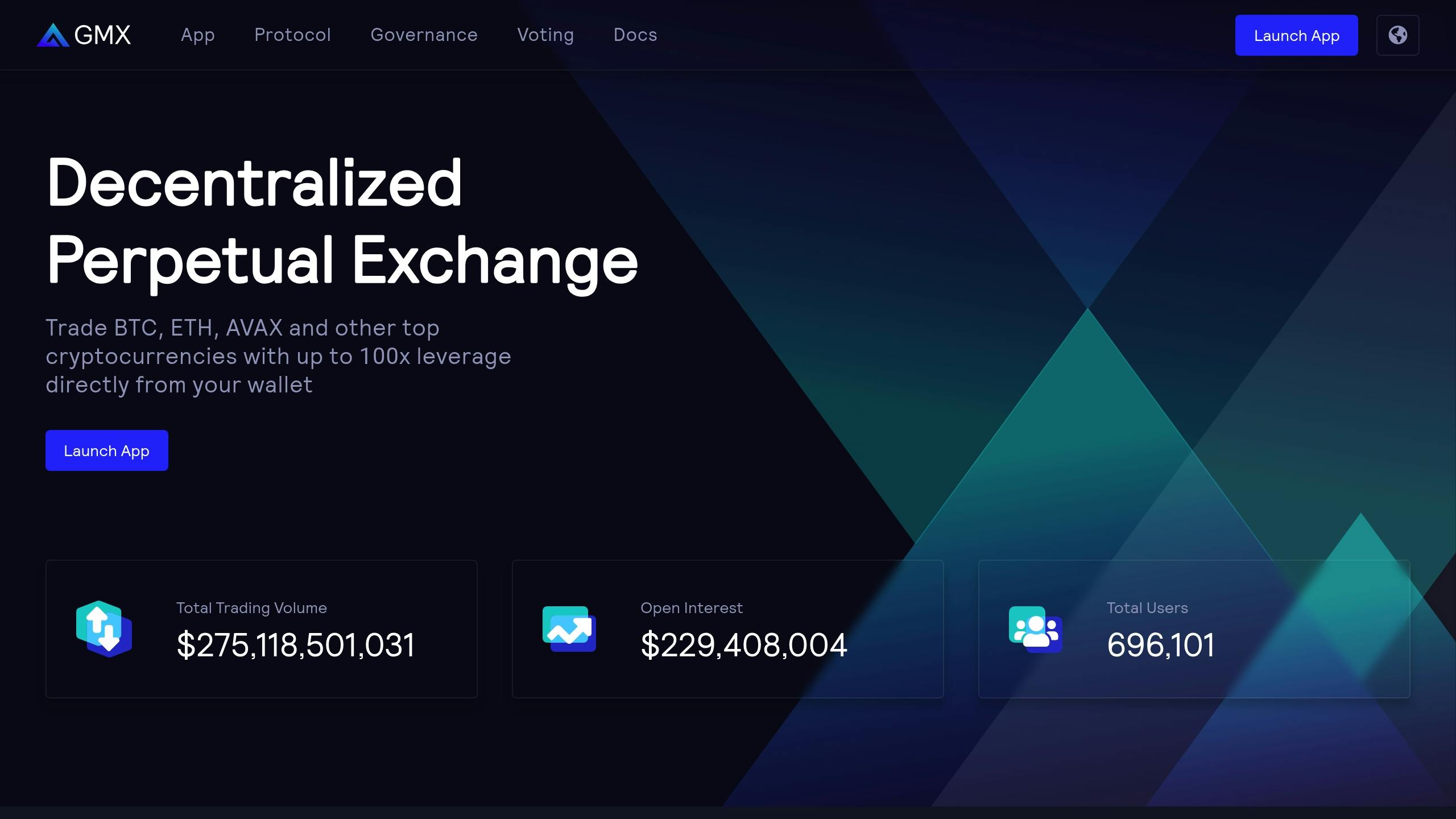

1. GMX Features

GMX operates on the Arbitrum and Avalanche networks, providing decentralized leverage trading with up to 50x leverage. While this is higher than dYdX’s 20x, it falls short of Binance’s 125x. That said, most users stick to modest leverage levels of 2-3x. This setup offers a flexible trading environment for a range of strategies.

Supported Cryptocurrencies

GMX V1 allows perpetual trading for a select group of major cryptocurrencies on its networks:

| Avalanche Network | Arbitrum Network |

|---|---|

| ETH/USD | AVAX/USD |

| BTC/USD | ETH/USD |

| LINK/USD | BTC/USD |

| UNI/USD | WBTC/USD |

GMX V2 significantly expands the trading options, introducing 31 trading pairs , including popular meme coins like DOGE and newer assets such as WIF and kPEPE. For spot trading, GMX V2 supports 10 coins on Arbitrum and 7 on Avalanche, including stablecoins like USDT and DAI .

Updated Fee Structure

GMX V2 not only increases its asset offerings but also adjusts its fee structure to be more competitive. Here’s a comparison of fees between GMX V1 and V2:

| Fee Type | GMX V1 | GMX V2 |

|---|---|---|

| Position Opening/Closing | 0.1% | 0.05–0.07% |

| Standard Token Swaps | 0.2–0.8% | 0.05–0.07% |

| Stablecoin Swaps | N/A | 0.005–0.02% |

However, some traders have raised concerns about fees cutting into their profits. As @ImNotTheWolf points out:

"Only on $GMX can you be +4.39% in profit, and still be in a -9.55% net loss due to outrageous fees."

To address this, GMX uses dynamic network fees that adapt to blockchain congestion. These fees estimate higher costs during peak times to ensure transactions go through and refund any unused amount . Compared to dYdX’s tiered maker-taker model (0.020% for makers, 0.050% for takers) , GMX’s flat-rate fees may be more appealing to casual traders looking for predictable costs.

Understanding these fee structures is essential when evaluating trading costs across decentralized exchanges.

2. dYdX Features

dYdX stands out as a decentralized platform for leverage trading, catering to both beginners and seasoned traders. It offers a wide range of markets and leverage options, making it a go-to choice for multi-market trading.

Leverage Options and Trading Markets

The platform offers different leverage limits based on the asset being traded. For instance, Bitcoin and Ethereum markets allow up to 20x leverage, while other markets are capped at 10x leverage . With 193+ trading markets available , dYdX provides plenty of trading opportunities.

| Asset Category | Maximum Leverage |

|---|---|

| BTC/ETH Markets | 20x |

| Other Markets | 10x |

| Total Available Markets | 193+ |

Key stats: dYdX processes $359M in daily trading volume across 150,465 trades, with $155M in open interest .

Asset Support and Collateral System

dYdX uses a cross-margin system, allowing all assets in an account to act as collateral . Supported cryptocurrencies include Ethereum (ETH), DAI, and USD Coin (USDC). Popular trading pairs like BTC-USD, ETH-USD, SOL-USD, and DOGE-USD offer a range of options for traders .

Competitive Fee Structure

The platform uses a maker-taker fee model with attractive rates:

| Fee Type | Rate Range |

|---|---|

| Maker Fees | 0.02% – 0% |

| Taker Fees | 0.05% – 0.2% |

| Liquidation Fee | 1% of position value |

| Fast Withdrawal | 0.1% of amount |

dYdX V4 removes gas fees for order submissions, cancellations, and deposits over 1,000 USDC . Compared to Uniswap’s flat 0.3% fee , dYdX’s structure is appealing, especially for active traders. Additionally, the platform offers free swaps between DAI, ETH, and USDC .

sbb-itb-dd9e24a

3. Vela Exchange Features

Vela Exchange handles an impressive $4.7 billion in trading volume and provides a range of leverage options while maintaining strong security protocols .

Leverage Trading Options

Vela offers varying leverage limits based on asset type:

| Asset Type | Maximum Leverage | Position Fee |

|---|---|---|

| BTC/ETH | 30x | 0.05% |

| Other Crypto | 30x | 0.06–0.08% |

| Forex | 100x | N/A |

For forex trading, Vela allows up to 100x leverage, which is higher than platforms like GMX that limit leverage to 50x . All trades require USDC as collateral .

Fee Structure and Cost Management

Vela’s fee system is designed to balance affordability and risk management:

| Fee Component | Details |

|---|---|

| Position Fees | BTC/ETH: 0.05%, Alts: 0.06–0.08% |

| VLP Minting | 0.05% (waived during promotional events) |

| Funding Fees | Velocity-based, with a 24-hour default period |

A portion of the fees (30–80%) is allocated to the vault, generating 20–30% yields. The fee structure adjusts dynamically based on a 21-day ATR to ensure flexibility and stability .

Security Protocols and Risk Management

Vela Exchange prioritizes security with several measures in place:

- Time Restrictions: Profits over $500 (BTC/ETH) or $250 (other cryptos) must be held for at least 5–7 minutes .

- Protective Features: A 24-hour withdrawal cooldown, capped minting limits, and dynamic slippage controls help mitigate risks .

Vela also uses real-time market data to refine risk parameters, ensuring a stable trading environment for both traders and liquidity providers .

These features reinforce Vela’s position in the competitive decentralized leverage trading space.

4. Defx Features

Defx stands out in decentralized leverage trading with competitive fees and a solid foundation on both Ethereum and Solana. This combination ensures strong security and flexible trading options, making it a key player in the decentralized trading space.

Trading Capabilities and Leverage Options

Defx offers leverage of up to 50x on major cryptocurrency pairs, giving traders significant flexibility. Its dual-network setup – integrating Ethereum and Solana – provides a unique edge over single-chain platforms. The platform supports both isolated and cross-margin trading, allowing users to optimize capital use and manage risks effectively.

Fee Structure and Trading Costs

Defx uses a tiered fee system based on trading volume, rewarding higher activity:

| Trading Tier | 30-Day Volume | Taker Fee | Maker Fee |

|---|---|---|---|

| Standard | ≤$5M | 0.055% | 0.02% |

| VIP 1 | >$5M | 0.05% | 0.018% |

| VIP 2 | >$10M | 0.045% | 0.016% |

| VIP 3 | >$50M | 0.04% | 0.014% |

| VIP 4 | >$100M | 0.03% | 0.01% |

| VIP 5 | >$500M | 0.02% | 0.005% |

For liquidity providers, Defx’s market maker program offers negative maker fees, going as low as -0.010% for those contributing substantial liquidity . Alongside its fee advantages, the platform emphasizes top-tier security.

Security and Risk Management

Defx incorporates several safety measures to protect users:

- Smart contract audits by third-party firms to address vulnerabilities.

- Multiple price oracles to minimize the risk of price manipulation.

- Ongoing regulatory monitoring to meet compliance standards .

To ensure market stability, liquidity incentives are offered, reducing slippage risks during volatile periods. These safeguards complement Defx’s advanced trading infrastructure.

Trading Infrastructure

Defx features a high-speed order matching system, providing fast and reliable trade execution. Its integration with Ethereum and Solana networks gives traders the flexibility to choose between lower costs or faster transactions.

As a non-custodial platform, Defx ensures users maintain full control over their assets. The permissionless token listing feature expands trading opportunities, aligning with the principles of decentralized finance. This infrastructure equips traders with the tools they need to manage risks while staying in control of their assets.

Platform Strengths and Limitations

This section provides a quick comparison of each platform’s advantages and drawbacks, helping traders choose what best suits their needs.

GMX: Focus on Security, Limited Asset Options

GMX stands out for its strong security measures and established market presence, with 669,000 users and $235 billion in trading volume . It prioritizes security through regular audits and bug bounty programs. Traders can access up to 50x leverage, making it appealing to a range of trading styles. However, its narrow selection of cryptocurrencies and fee structure (0.05-0.07% for opening/closing positions) might limit some strategies. For traders seeking volume-based incentives, dYdX could be a better fit.

dYdX: Rewards for High-Volume Traders

dYdX uses a volume-based fee model, potentially reducing fees to 0% for highly active users . It supports over 35 cryptocurrencies and provides up to 20x leverage for BTC and ETH markets . Built on StarkEx, its layer-2 technology improves transaction efficiency. Despite recent declines in total value locked (TVL), which affects liquidity, dYdX remains a strong player. Unlike GMX, Vela Exchange focuses on offering higher leverage options.

Vela Exchange: Designed for High Leverage

Vela Exchange appeals to seasoned traders with leverage options up to 30x for cryptocurrencies and 100x for forex . Its fee structure varies by asset and transaction type, and it includes advanced risk management tools. While this platform is ideal for experienced users, beginners may find it complex. For those seeking broader flexibility, Defx might be a better alternative.

Defx: Flexibility Across Multiple Networks

Defx operates on both Ethereum and Solana, offering versatile order execution and a tiered fee structure that rewards higher trading volumes. It provides up to 50x leverage, balancing risk and opportunity across its dual-network setup. However, performance can depend on network conditions, which may be a drawback for some traders.

Comparative Analysis

The table below highlights key features across the platforms for easier comparison:

| Feature | GMX | dYdX | Vela Exchange | Defx |

|---|---|---|---|---|

| Max Leverage | 50x | 20x | 30x (crypto), 100x (forex) | 50x |

| Trading Fees | 0.05-0.07% | 0-0.05% (volume-based) | Tiered | Tiered |

| Key Strength | Security focus | Volume incentives | High leverage | Multi-chain support |

| Primary Limitation | Limited assets | Declining TVL | Complex for beginners | Network dependence |

Choosing the right platform depends on your priorities – whether it’s security (GMX), lower costs (dYdX), higher leverage (Vela Exchange), or flexibility across networks (Defx). Each platform caters to different types of traders in the decentralized leverage trading space.

Summary and Recommendations

Based on our analysis, here are the recommended platforms tailored to specific trading needs:

- For Security-Oriented Traders: GMX stands out with zero-slippage trading, low fees (10 bps), and leverage up to 50x .

- For High-Volume Traders: dYdX handles approximately $35 billion in monthly trading volume and supports 193 markets , offering a central limit order book ideal for diverse strategies.

- For Advanced Risk-Takers: Vela Exchange offers higher leverage options but comes with a steeper learning curve, making it better suited for experienced traders.

- For Multi-Network Flexibility: Defx operates on Ethereum and Solana, delivering high-speed order matching, flexible margin options, and permissionless token listing for early market opportunities.

Here’s a quick comparison to match platforms with trading priorities:

| Trading Priority | Recommended Platform | Key Advantage | Best For |

|---|---|---|---|

| Security | GMX | Zero-slippage trading | Risk-averse traders |

| Volume Trading | dYdX | 193 trading markets | Active traders |

| High Leverage | Vela Exchange | High leverage options | Experienced traders |

| Multi-Chain Access | Defx | Dual-network support | Cross-chain traders |

These recommendations help align platform features with what traders prioritize most – security, trading volume, leverage, or network flexibility. Beginners may find dYdX’s user-friendly interface and educational tools especially helpful. Meanwhile, seasoned traders should consider the broader context: decentralized derivatives currently account for just 1.7% of centralized trading volume , but with GMX’s impressive 230% annual growth rate , these platforms are poised for expansion.