Uniswap Alternatives

Explore various Uniswap alternatives that offer unique features like lower fees, faster transactions, and advanced trading tools.

Looking for Uniswap alternatives? Here’s a quick guide to top decentralized exchanges (DEXs) that cater to different trading needs like lower fees, faster transactions, and advanced tools:

- SushiSwap: Multi-chain trading with yield farming, staking, and cross-chain swaps.

- PancakeSwap: Low-cost trading on BNB Chain with a simple interface.

- Raydium: High-speed, low-fee trading on Solana, ideal for quick transactions.

- dYdX: Advanced leverage trading tools for professional traders.

- Defx Perps: High-leverage trading (up to 50x) with dual-chain support (Ethereum and Solana).

Quick Comparison

| Platform | Network | Key Features | Fees | Best For |

|---|---|---|---|---|

| SushiSwap | Ethereum + 15 | Yield farming, cross-chain swaps | 0.25% LP fee, 0.05% staking fee | Multi-chain trading |

| PancakeSwap | BNB Chain | Simple interface, low gas fees | Lower than Ethereum | Beginners, cost-conscious |

| Raydium | Solana | Fast transactions, low fees | Minimal fees | Speed-focused traders |

| dYdX | Ethereum | Leverage trading, advanced tools | Low fees | Experienced traders |

| Defx Perps | Ethereum+Solana | High-leverage (up to 50x), pre-launch markets | Not specified | High-risk, high-reward users |

Each platform offers unique benefits depending on your trading goals. Whether you’re looking for low fees, fast transactions, or advanced features, there’s a DEX for you. Keep reading for more details on each!

SushiSwap vs Uniswap: A Detailed Comparison of Leading DEXs

1. SushiSwap: Ethereum-Based Trading

SushiSwap, originally a fork of Uniswap on Ethereum, offers token swaps alongside advanced decentralized finance (DeFi) features. It supports more than 11,000 trading pairs and operates across 15 blockchains, including Arbitrum, Optimism, and Polygon.

The platform uses an automated market maker (AMM) model and has a dual reward system:

| Reward Type | Percentage | Recipient |

|---|---|---|

| Trading Fees | 0.25% | Liquidity Providers |

| Additional Fees | 0.05% | xSUSHI Token Holders |

This system incentivizes participation and fuels SushiSwap’s ongoing development.

Key features include SushiXSwap, which simplifies cross-chain transfers, and Kashi, a lending platform that provides extra earning opportunities. These additions make SushiSwap more than just a decentralized exchange (DEX).

Governance is another highlight. SUSHI token holders play an active role in decision-making, shaping the platform’s direction and growth. This community-driven approach has helped SushiSwap evolve into a broader DeFi ecosystem.

Why Traders Choose SushiSwap

- Lower fees thanks to support for multiple blockchains

- Opportunities for yield farming and staking

- Integrated lending markets via Kashi

- Community-driven governance for platform improvements

- Effortless cross-chain transfers without the need for wrapping

SushiSwap blends traditional trading tools with features designed to reduce costs and improve efficiency across chains.

2. PancakeSwap: BNB Chain Trading

PancakeSwap operates on the Binance Smart Chain (BSC), offering quick transaction confirmations and low fees. It supports various decentralized finance (DeFi) activities like yield farming, staking, and participating in lotteries, all within its native BEP-20 token ecosystem.

Using an automated market maker (AMM) model, PancakeSwap enables users to provide liquidity and earn CAKE tokens. Additionally, CAKE holders can take part in governance by voting on platform proposals.

With wallet-to-wallet BEP-20 swaps, PancakeSwap provides a straightforward trading experience that caters to both beginners and seasoned traders.

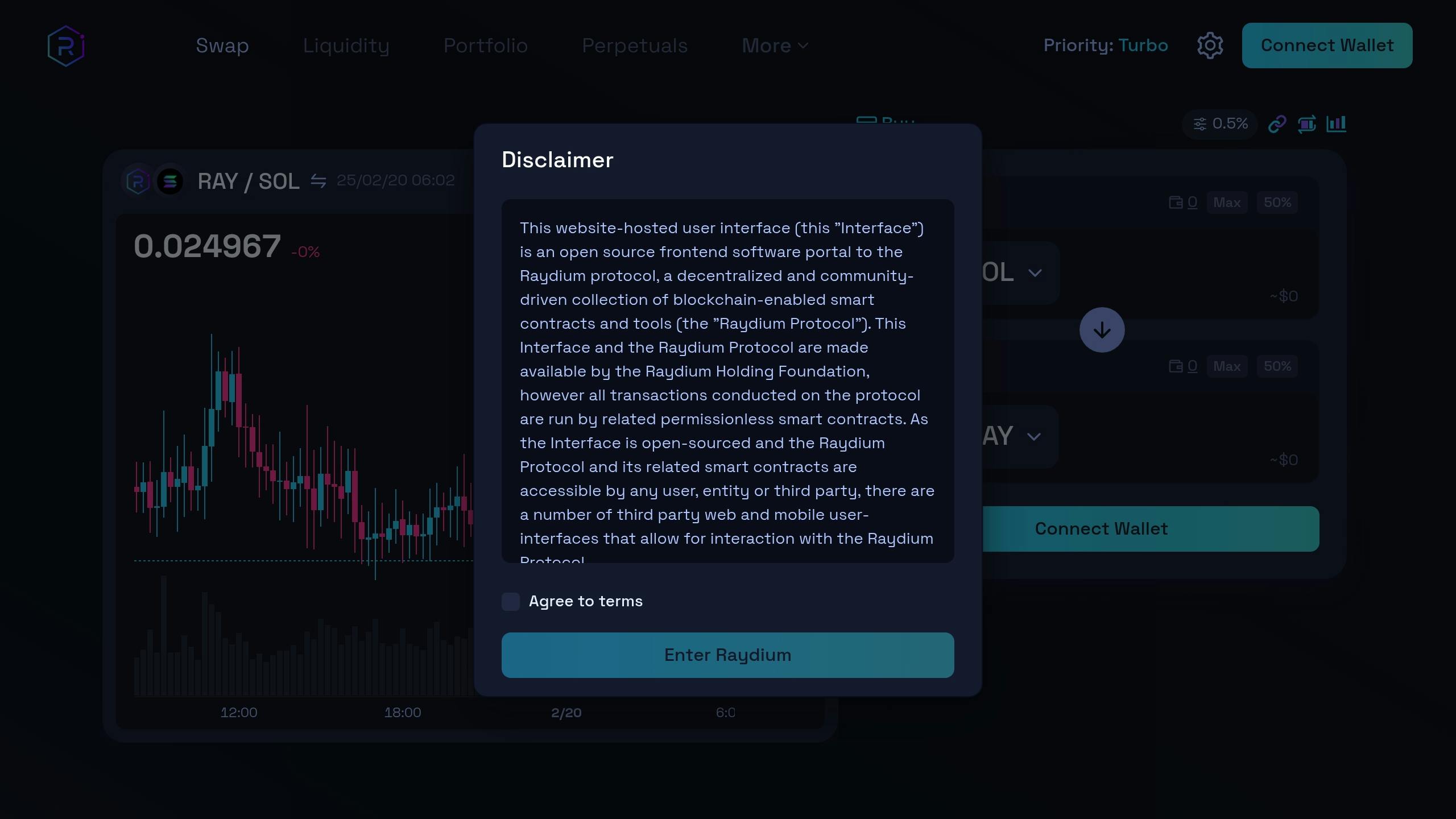

3. Raydium: Solana DEX Trading

Raydium stands out among decentralized exchanges (DEXs) by taking full advantage of Solana’s blockchain. Its high-speed and low-cost infrastructure ensures fast transactions and minimal fees, making it a strong choice for traders.

Using an Automated Market Maker (AMM) model tailored for Solana, Raydium processes up to 65,000 transactions per block. This setup minimizes slippage and works well for high-frequency trading.

Raydium offers more than just token swaps. Its platform includes a range of DeFi tools:

| Feature | What It Offers |

|---|---|

| Liquidity Pools | Provide token pairs and earn rewards |

| Yield Farming | Stake tokens to earn extra incentives |

| Cross-Platform Integration | Connect with other DeFi apps on Solana |

These tools are seamlessly integrated into Raydium’s design, providing users with a smooth trading experience.

Another highlight is Raydium’s governance model, powered by its native token. This gives users a voice in the platform’s future while maintaining its focus on speed and cost efficiency.

For traders looking to save on fees, Raydium is a great option. Unlike Ethereum-based platforms, which often have high gas fees, Raydium’s transactions typically cost just a fraction of a cent. This makes it accessible to all traders, regardless of how much they’re trading.

That said, Raydium’s reliance on the Solana blockchain does come with some risks. If Solana experiences network issues, it could impact trading on Raydium. It’s a trade-off between performance and dependency that users should keep in mind.

sbb-itb-dd9e24a

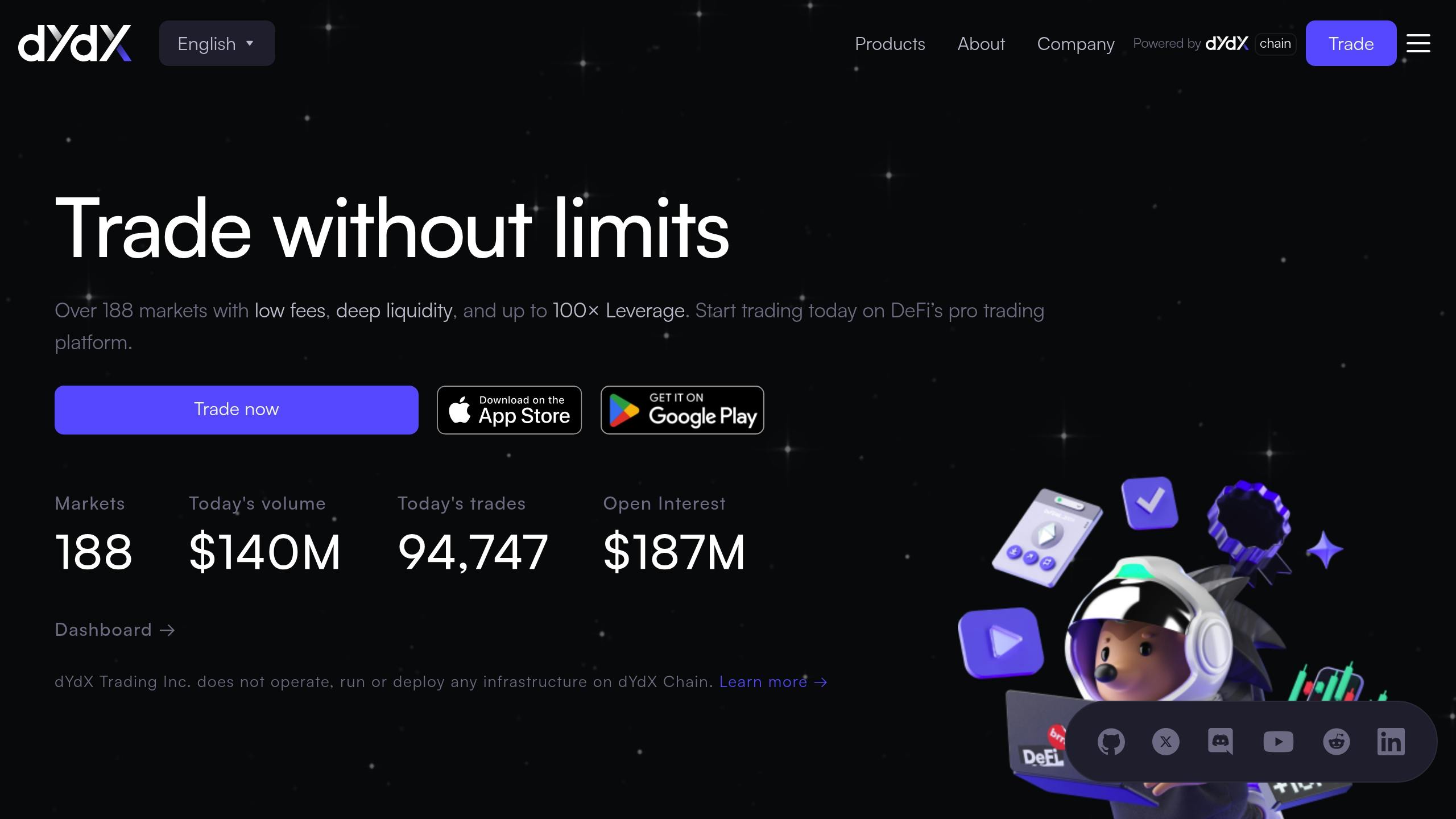

4. dYdX: Leverage Trading Platform

dYdX has carved out a niche in the decentralized exchange space by focusing on leverage trading. Built on Ethereum, it’s designed for traders who want to execute advanced strategies and take leveraged positions.

What sets dYdX apart is its powerful trading toolkit. Unlike many other decentralized exchanges, it provides features tailored to serious traders:

| Feature | Purpose |

|---|---|

| Perpetual Trading | Trade perpetual contracts with leverage |

| Spot Markets | Seamless token-to-token trades with strong liquidity |

| Margin Trading | Manage capital effectively for leveraged positions |

These tools deliver a trading experience that prioritizes accuracy and speed.

The platform’s smart contract system ensures secure and decentralized trade execution. Its order book model helps improve price accuracy and reduces slippage – especially important for larger trades. However, this level of technical sophistication also requires traders to be vigilant about risk.

Risk management is key here. While leveraged trading offers opportunities for higher returns, it also increases exposure to market swings. This makes dYdX most suitable for seasoned traders who can navigate these risks with well-planned strategies.

On top of that, dYdX provides a fee structure that appeals to traders looking to minimize costs.

5. Defx Perps DEX: High-Leverage Trading

Defx Perps DEX offers traders the opportunity to trade with up to 50x leverage, catering to those looking for greater market exposure. Here’s how the platform stands out in the world of high-leverage trading.

Defx combines the strengths of Ethereum’s security and Solana’s high-speed performance through its dual-chain setup. This ensures fast and reliable order execution.

Key Trading Features

Defx Perps DEX provides two margin types to suit different trading strategies:

- Isolated Margin: Collateral is tied to specific positions, helping limit risk exposure.

- Cross Margin: Collateral is shared across multiple positions, allowing better use of trading capital.

One unique feature is its pre-launch token markets, giving traders early access to new cryptocurrencies before their official listings. This opens up speculative opportunities for those eager to get ahead.

Risk Management and Security

To help manage risks, the platform includes tools like automated liquidation, position size limits, and real-time margin monitoring with alerts. These features are designed to minimize potential losses.

On the security front, Defx uses a non-custodial trading model, meaning users maintain full control of their assets while trading. Despite being a decentralized exchange, it offers trading tools comparable to those found on centralized platforms.

Things to Keep in Mind

Trading with high leverage – especially up to 50x – is inherently risky. Even small price shifts can lead to liquidation.

Lastly, the platform offers a competitive fee structure, with discounts for high-volume traders based on their activity. This makes it an appealing choice for active participants in the market.

Platform Comparison Chart

Here’s a breakdown of key features, fees, and trading capabilities for some of the top Uniswap alternatives. Use this to weigh your options and decide which platform suits your needs.

| Platform | Network | Trading Features | Fees | Key Features | Total Value Locked |

|---|---|---|---|---|---|

| SushiSwap | Ethereum + 15 chains | Spot trading, yield farming, cross-chain swaps | 0.25% LP fee, 0.05% staking fee | Supports 15 networks, 11,000+ trading pairs | Strong TVL across chains |

| PancakeSwap | BNB Chain | Spot trading | Lower gas fees than Ethereum DEXs | Simple interface, high liquidity | High liquidity on BNB Chain |

| dYdX | Ethereum | Leverage trading, lending, short selling | Low fees | Advanced trading tools | Large daily trading volume |

| Defx Perps | Ethereum + Solana | High-leverage trading, pre-launch markets | Not specified | Up to 50x leverage, dual-chain setup | Focus on perpetual futures |

Network Performance and Security

The blockchain network backing each platform plays a big role in performance and reliability:

- Ethereum-based platforms like SushiSwap and dYdX provide strong security but come with higher gas fees.

- BNB Chain platforms such as PancakeSwap offer quicker transactions and lower costs.

- Hybrid platforms like Defx combine multiple chains to balance speed and security.

Trading Volume and Liquidity

Liquidity and trading volume can vary widely across these platforms:

- SushiSwap boasts over 11,000 trading pairs with deep liquidity pools.

- PancakeSwap leads in trading volume on the BNB Chain.

- dYdX specializes in derivatives with impressive daily volume.

- Defx focuses on perpetual futures with tailored liquidity solutions.

User Experience Considerations

The right platform often depends on your trading experience and goals:

- Beginners appreciate PancakeSwap’s straightforward design.

- Experienced traders are drawn to dYdX’s advanced tools.

- Cross-chain users benefit from SushiSwap’s multi-network flexibility.

- High-risk, high-reward traders value Defx’s leverage-focused features.

How to Choose a DEX

When selecting a decentralized exchange (DEX), trading volume is a key factor. High trading volume ensures market depth, leading to efficient trades with minimal slippage. For instance, platforms like SushiSwap handle large volumes across multiple chains, making asset conversions more reliable. Another important aspect is the fee structure, which directly affects your trading costs.

Here’s a quick look at how fees impact trading:

| Fee Type | Impact on Trading | Example Platform |

|---|---|---|

| Trading Fees | Affects profit margins | SushiSwap (0.3% total fee) |

Make sure the DEX you choose supports your preferred blockchain network. Multi-chain platforms provide flexibility for users operating across Ethereum, BNB Chain, Polygon, and Avalanche.

- Ethereum users: SushiSwap and dYdX are great for their strong security features.

- BNB Chain users: PancakeSwap is known for its cost-efficient transactions.

- Solana users: Raydium offers high-speed trading.

If you need more than the basics, look into advanced features that align with your trading goals:

- For leverage, dYdX provides professional tools, and Defx Perps offers up to 50x leverage with options for isolated and cross-margin trading.

- For cross-chain trading, platforms like SushiSwap make transferring assets between blockchains seamless.

Security Considerations

Security should always be a top priority. Look for platforms that include:

- Regular audits of their smart contracts

- Multi-signature wallet features

- A solid reputation in the market

These measures add an extra layer of confidence alongside the technical and financial factors.

User Interface and Experience

The design of a DEX can make or break your trading experience. PancakeSwap’s simple interface is perfect for beginners, while dYdX caters to more experienced traders with advanced tools. Choose a platform that matches your skill level and trading style.

FAQs

What is the best alternative to Uniswap?

The best alternative to Uniswap depends on what you’re looking for in a trading platform. Here are some top picks tailored to different needs:

| Trading Need | Recommended Platform | Key Advantage |

|---|---|---|

| Multi-chain Trading | SushiSwap | Supports cross-chain swaps with yield farming |

| Low-cost Trading | PancakeSwap | Lower fees on the BNB Chain |

| High-speed Trading | Raydium | Quick transactions on Solana |

| Leverage Trading | dYdX | Advanced tools for professional traders |

| High Leverage | Defx Perps | Offers up to 50x leverage options |

Each of these platforms shines in a specific area. SushiSwap is great for multi-chain trading, PancakeSwap keeps costs down, Raydium delivers speed, dYdX caters to leverage trading, and Defx Perps provides high-leverage opportunities.

When deciding on a platform, keep these factors in mind:

- Transaction fees and gas costs: Make sure the costs fit your budget.

- Liquidity: Check if your preferred trading pairs have enough liquidity.

- Security: Look into the platform’s audit history and safety measures.

- Ease of use: Choose a platform that matches your experience level.

- Specific features: Consider what you need, like leverage or yield farming.