What is Uniswap? How do AMMs work?

Explore how Uniswap and AMMs revolutionize decentralized trading, enabling direct wallet-to-wallet token swaps and passive income opportunities.

Uniswap is a decentralized exchange (DEX) built on Ethereum that allows you to trade ETH and ERC-20 tokens directly from your wallet without intermediaries. It uses Automated Market Makers (AMMs) instead of traditional order books, relying on liquidity pools managed by smart contracts to automate trades.

Key Points:

- Uniswap’s AMM Model: Trades occur through liquidity pools, not by matching buyers and sellers.

- Liquidity Pools: Users provide token pairs (e.g., ETH/USDC) to pools and earn a 0.3% trading fee.

- Price Mechanism: Uses the formula

x * y = k, where token ratios determine prices. - How to Trade: Connect a wallet like MetaMask, select tokens, and swap while considering gas fees and slippage.

Quick Comparison:

| Feature | Traditional Exchanges | Uniswap (AMM Model) |

|---|---|---|

| Order Matching | Buyers and sellers matched | Uses liquidity pools |

| Control | Centralized | Decentralized |

| Liquidity | Limited by orders | Always accessible |

| Fee Distribution | Retained by exchange | Paid to liquidity providers |

Uniswap simplifies crypto trading while offering earning opportunities for liquidity providers. Its open-source, decentralized nature makes it a popular choice in the DeFi space.

AMM Core Mechanics

How Liquidity Pools Work

Liquidity pools are at the heart of how Uniswap operates. These pools contain two tokens provided by users, called liquidity providers, who earn a share of the trading fees in return. When you add tokens to a pool, you get pool tokens, which represent your portion of the total liquidity. For instance, if you create an ETH/USDC pool, you’ll need to deposit both tokens in equal market value. This ensures the pool’s pricing stays aligned with external markets. Liquidity providers typically earn around 0.3% in fees on every trade made in the pool.

AMM Price Calculations

Uniswap relies on the constant product formula (x * y = k) to set token prices in its liquidity pools. Here, x and y represent the amounts of the two tokens, while k is a fixed constant. This setup means larger trades result in higher slippage. Smaller trades usually have little effect on the price, but bigger trades can cause noticeable slippage. This mechanism helps maintain the pool’s overall liquidity and stability.

Step-by-Step Trading Process

- Connect your Web3 wallet (like MetaMask) to Uniswap.

- Pick the tokens you want to swap.

- Enter the trade amount.

- Check the trade details, including the exchange rate, price impact, and minimum output.

- Approve the transaction and pay the gas fees.

Uniswap’s smart contracts handle trades using the constant product formula and allocate fees to liquidity providers. To trade efficiently, keep an eye on the price impact for large transactions, consider splitting big trades across multiple pools, and include gas fees in your total cost calculations.

Related video from YouTube

Uniswap Main Features

Uniswap builds on the fundamentals of Automated Market Maker (AMM) technology, offering a platform that simplifies trading while providing opportunities to earn.

Direct Trading Without Middlemen

Uniswap removes the need for intermediaries by allowing direct, non-custodial trading. Unlike centralized exchanges that hold your funds, Uniswap lets you trade straight from your personal wallet. This means you stay in control of your assets until the trade is completed.

Trades on Uniswap are processed by Ethereum-based smart contracts, ensuring both transparency and security. When you execute a swap, it’s handled by these publicly auditable smart contracts. This direct approach not only simplifies trading but also ties into Uniswap’s fee structure and token pair features.

Earning Through Pool Fees

Uniswap offers a way to earn passive income by becoming a liquidity provider. By depositing token pairs into liquidity pools, providers earn a 0.3% fee on every trade involving their pool. These fees are automatically added to your position.

Here’s a breakdown of how fees work:

| Fee Type | Percentage | Who Pays/Receives |

|---|---|---|

| Trading Fee | 0.3% | Paid to liquidity providers |

| Protocol Fee | 0% | No protocol fee currently |

| Gas Costs | Variable | Paid by traders for transactions |

Supported Token Pairs

Uniswap supports all ERC-20 tokens on the Ethereum network. Its open, permissionless setup allows anyone to create new token pairs, leading to a wide range of trading options.

Popular trading pairs include:

- ETH/USDT

- ETH/DAI

- WBTC/ETH

- UNI/ETH

New token pairs require initial liquidity to get started. UNI token holders also play a role in shaping the platform’s future direction.

sbb-itb-dd9e24a

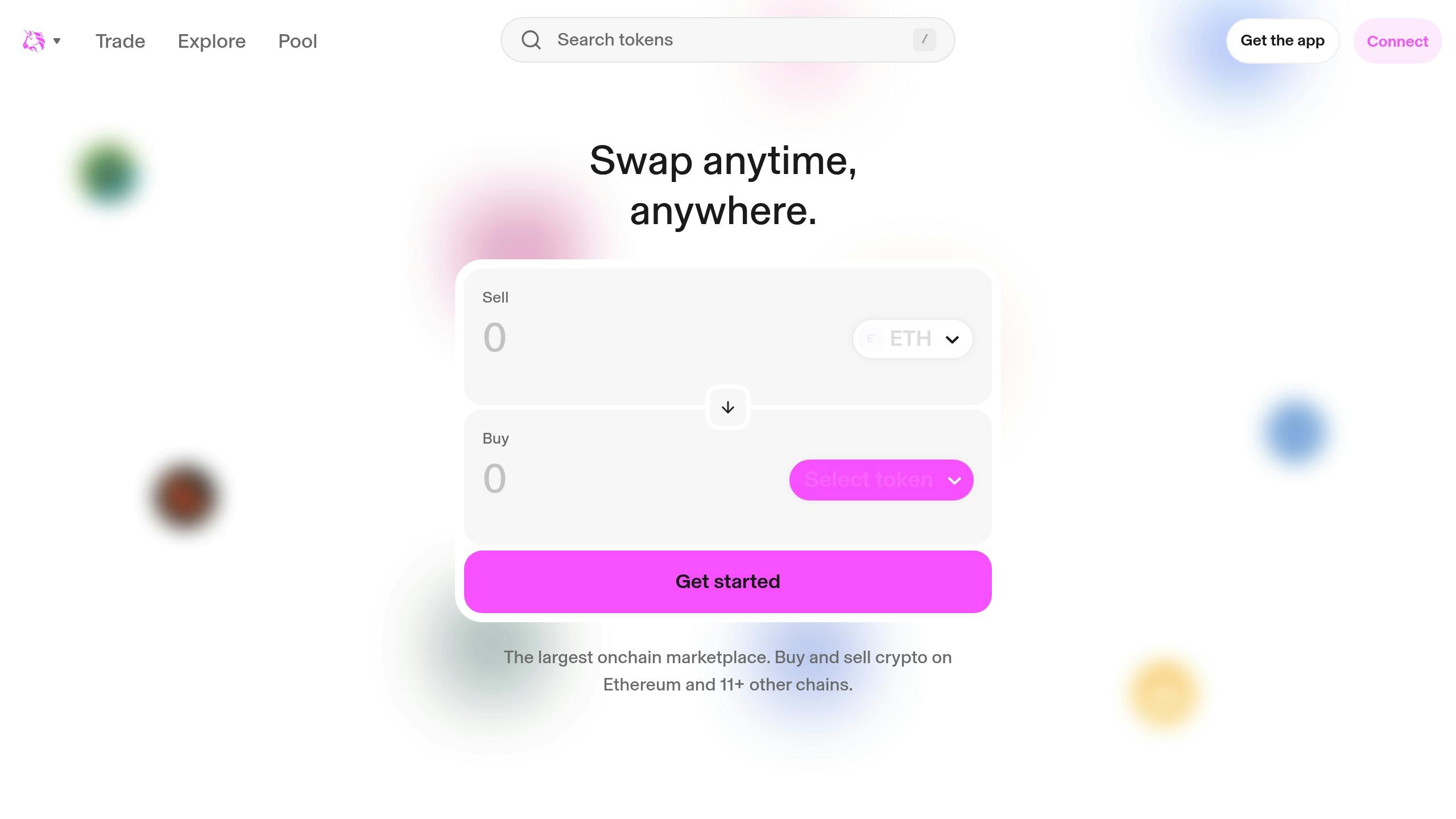

Getting Started with Uniswap

Wallet Setup Guide

To trade on Uniswap, you’ll need a compatible wallet. Two popular choices are MetaMask and Trust Wallet, both of which integrate smoothly with Uniswap’s platform. Here’s how to get started:

- Download and install a wallet (MetaMask is great for desktop users).

- Create your wallet and securely back up your recovery phrase.

- Add ETH to your wallet for trading and covering gas fees.

- Go to app.uniswap.org.

- Click on "Connect Wallet" and select your wallet provider.

Important: Keep your recovery phrase offline and never enter it on any website. After setting up your wallet, you’ll be ready to make your first trade.

Making Your First Trade

Once your wallet is connected, follow these steps to complete a trade:

| Step | Details |

|---|---|

| Token Selection | Pick any ERC-20 token pair for your trade. |

| Amount Input | Enter the amount you wish to swap. |

| Slippage Settings | Default is 0.5%; adjust based on volatility. |

| Gas Fees | Check the current network fees. |

| Transaction Review | Double-check all details before confirming. |

Trading Tips and Costs

Here are some tips to help you trade effectively:

- Use tools like Etherscan‘s gas tracker to monitor gas prices and liquidity, reducing costs and slippage.

- Trade during off-peak hours (late night or early morning UTC) to save on gas fees.

- Adjust slippage tolerance based on the token pair:

- Stablecoin pairs: 0.1-0.5%.

- Volatile tokens: 1-3% or higher, depending on market conditions.

"Uniswap has facilitated over 465 million swaps and has a trading volume of over $2 trillion", showcasing its dominance in the DeFi space.

When setting slippage, remember that stablecoin pairs generally require lower tolerance, while volatile tokens may need higher settings to ensure your transaction goes through.

Main Points Recap

Uniswap’s Automated Market Maker (AMM) system eliminates traditional order books, simplifying the trading process. Its impressive trading volume highlights the growing influence of AMMs in the market. This system sets the stage for future developments in AMM technology and cross-chain capabilities.

The platform’s liquidity pools, managed by smart contracts, ensure smooth and efficient trading. Whether you’re a casual trader or a seasoned investor, Uniswap offers several standout features:

| Feature | Benefit |

|---|---|

| Transparency | Open-source code and verifiable transactions |

| Accessibility | Round-the-clock direct trading |

| Liquidity | Automated pool rebalancing for constant availability |

The Future of AMMs

Uniswap’s focus on innovation and cross-chain integration is shaping the next phase of AMMs. Its expansion to blockchains like Base, Polygon, and Arbitrum reflects a growing trend toward improved cross-chain functionality. Additionally, Ethereum’s move to proof-of-stake has already boosted Uniswap’s efficiency.

Key areas to watch include:

- Scalability: Advancements through Layer 2 solutions

- Security: Better risk management and protective measures

- Blockchain Integration: Partnerships with emerging networks

UNI token holders play a central role in guiding the platform’s evolution, ensuring updates align with the community’s needs. As decentralized finance (DeFi) continues to grow, AMMs like Uniswap are set to become even more influential in shaping the future of digital asset trading.

FAQs

How to use AMMs?

Automated Market Makers (AMMs) function differently from traditional order book systems. Instead of matching buyers and sellers, they use liquidity pools containing token pairs. Prices adjust automatically based on the ratio of tokens in the pool. For example, in a pool with ETH and USDC, trading between these tokens changes their relative prices.

Key Components for Trading:

| Component | Function | User Benefit |

|---|---|---|

| Liquidity Pools | Hold paired tokens for trading | Access to liquidity |

| Pool Fees | Reward liquidity providers | Opportunity to earn |

Practical Tips for Using AMMs:

- Use a secure non-custodial wallet like MetaMask to connect and trade.

- Always check the liquidity of a pool before making trades.

- If you’re interested in earning, consider adding liquidity to pools and collecting a share of the trading fees.

Things to Keep in Mind:

Prices in AMMs are determined by mathematical formulas, not traditional market orders. This can cause price differences compared to centralized exchanges, especially for large trades. The constant product formula used by most AMMs might also lead to higher slippage on bigger transactions.

AMMs offer decentralized trading while keeping your assets under your control, making them a flexible choice for crypto enthusiasts.