Bitcoin’s price action has reached a critical juncture at $103,000, with analysts identifying $107,000 as a make-or-break level that could determine the next major move. Recent technical analysis shows increasing uncertainty as the leading cryptocurrency consolidates in a tight range.

Key Technical Levels Under Watch

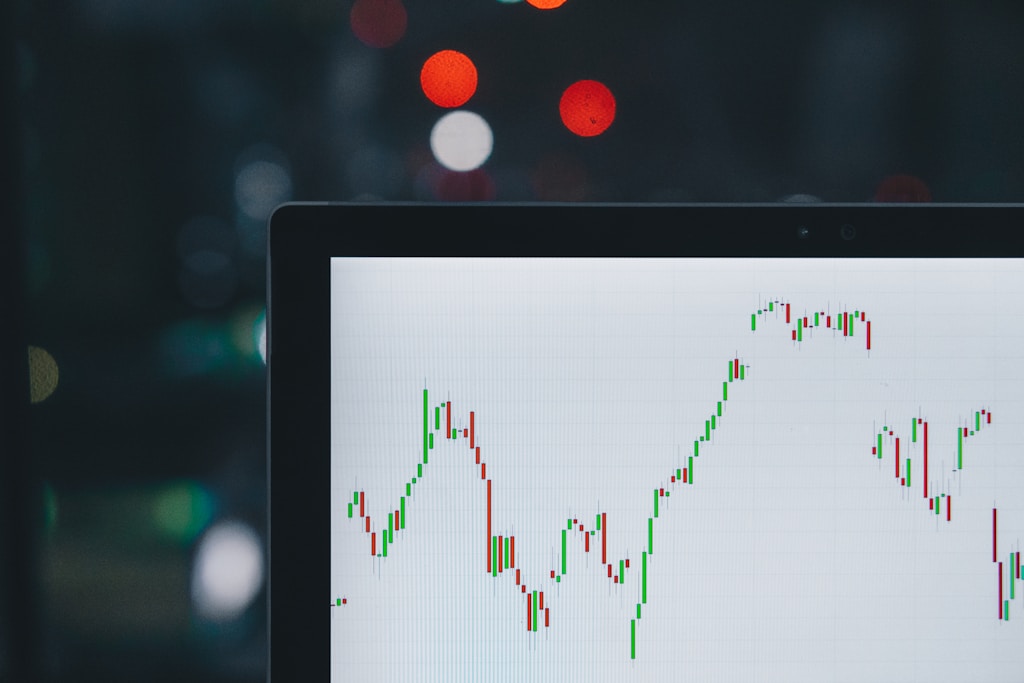

After an impressive rally earlier this month, Bitcoin has entered a period of consolidation above $103,000. The daily chart reveals persistent resistance at $107,000, with price action forming a compressed horizontal band that signals growing market indecision.

Crypto analyst Ali Martinez emphasizes that a daily close above $107,000 is crucial for maintaining bullish momentum. Historical data shows multiple failed attempts to breach this threshold since December 2024, creating a strong horizontal barrier just below $108,000. Notably, even Bitcoin’s recent all-time high of $108,786 couldn’t sustain above this critical level.

SPONSORED

Trade Bitcoin with up to 100x leverage and maximize your profit potential

Potential Bearish Scenario Emerges

A more cautious outlook comes from analyst TehThomas on TradingView, who identifies a possible trap setup. The current range between $100,000 and $105,800 could be attracting premature breakout trades, with liquidity pooling at both extremes.

The analysis suggests that a brief push above $105,800 might precede a sharp reversal toward the $98,000-$97,500 demand zone. This area represents a significant fair value gap and golden pocket level that could provide strong support.

Market Implications and Trading Considerations

Traders should note that the bearish scenario would be invalidated if Bitcoin maintains position above $105,800 with strong volume. Recent institutional inflows through ETFs could provide additional support for sustained upward momentum.

FAQ Section

Q: What is the key resistance level for Bitcoin right now?

A: The critical resistance level is $107,000, which needs to be cleared with a daily close for continued bullish momentum.

Q: What’s the worst-case scenario for Bitcoin’s price?

A: Technical analysis suggests a potential drop to the $98,000-$97,500 support zone if the current consolidation fails.

Q: What would invalidate the bearish scenario?

A: Sustained trading above $105,800 with strong volume would likely prevent the projected drop to $98,000.

At time of writing, Bitcoin trades at $103,914, showing minimal change (-0.06%) over the past 24 hours.