In a dramatic market downturn, Bitcoin and traditional markets faced severe pressure as Trump’s Liberation Day tariffs sent shockwaves through the global financial system, erasing an estimated $2 trillion in market value.

Market Impact and Bitcoin’s Response

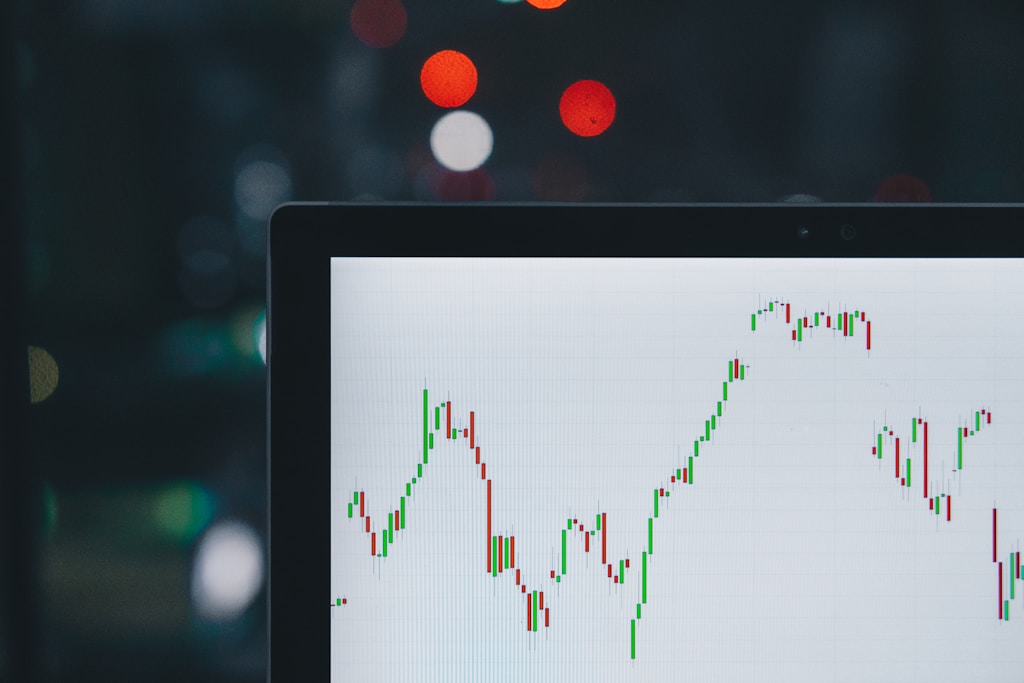

The cryptocurrency market showed its continued correlation with traditional risk assets as Bitcoin responded negatively to Trump’s sweeping tariff announcements. This market reaction demonstrates the increasing interconnectedness between crypto and mainstream financial markets, particularly during periods of significant macroeconomic uncertainty.

Understanding the Tariff Impact

The announced tariffs have triggered widespread concern about:

- Rising inflation expectations

- Potential economic growth slowdown

- Global trade disruptions

- Supply chain complications

Investor Sentiment and Risk Assessment

Market participants are actively reassessing their risk exposure, with many choosing to move capital to traditionally safer assets. This flight to safety has particularly impacted high-risk assets like cryptocurrencies and growth stocks.

SPONSORED

Navigate market volatility with up to 100x leverage on perpetual contracts

Expert Analysis and Market Outlook

Market analysts suggest this could be a temporary setback, though the full impact of the tariffs remains to be seen. The situation continues to develop as markets digest the implications of these policy changes.

FAQ Section

How will Trump’s tariffs affect Bitcoin long-term?

The long-term impact remains uncertain, but historical data suggests market volatility typically stabilizes after initial policy shock.

What should crypto investors do during this market downturn?

Financial advisors recommend maintaining a balanced portfolio and avoiding panic selling during periods of market stress.

Could this lead to a broader market correction?

While possible, many analysts believe current market fundamentals remain strong despite the temporary disruption.