Bitcoin’s price is showing remarkable stability around the $84,000 level as markets brace for Donald Trump’s highly anticipated ‘Liberation Day’ announcement and the upcoming U.S. jobs report. Recent market rallies ahead of Trump’s trade policy announcement suggest investors are carefully positioning themselves for potential market-moving developments.

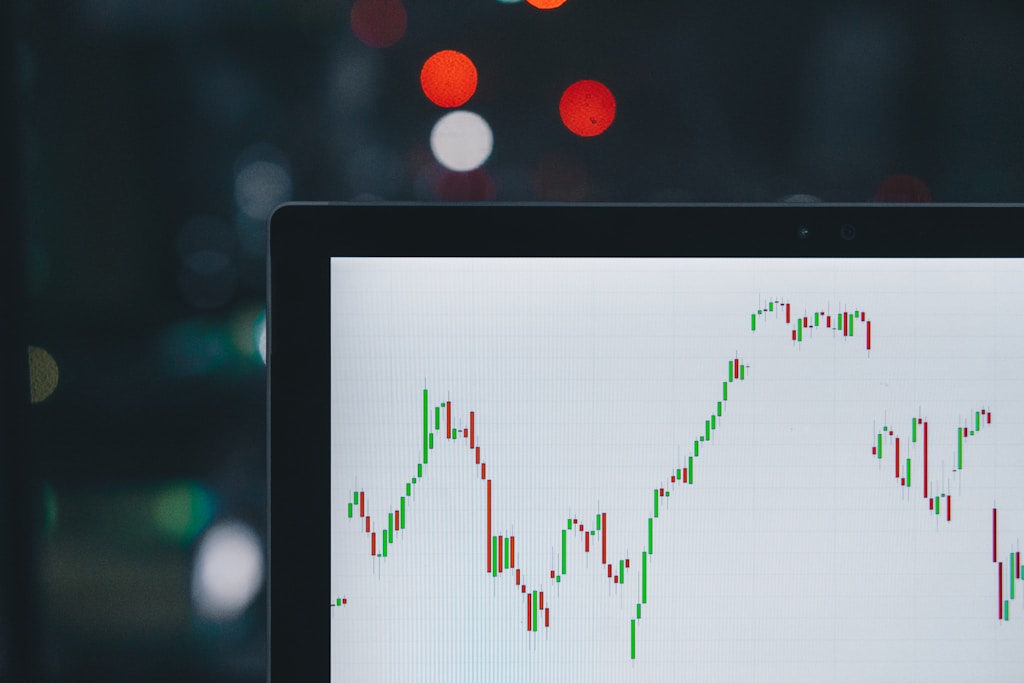

Market Analysis: Bitcoin’s Resilient Price Action

Bitcoin has maintained its position above the crucial $80,000 support level, demonstrating strong market fundamentals despite broader economic uncertainties. Recent data showing increased whale accumulation suggests institutional confidence remains high despite short-term price fluctuations.

Trump’s Trade Policy Impact on Crypto Markets

Market experts anticipate significant volatility as Trump’s trade policy announcement approaches. Analysis indicates potential tariff adjustments could strengthen Bitcoin’s digital gold narrative, particularly if global trade tensions escalate.

SPONSORED

Maximize your trading potential with up to 100x leverage on perpetual contracts

Jobs Report: Additional Market Catalyst

The upcoming jobs report could add another layer of complexity to market dynamics. Strong employment data might influence Federal Reserve policy decisions, potentially impacting Bitcoin’s price trajectory in the near term.

Expert Analysis and Market Outlook

According to leading market analysts, a reversal on tariffs appears ‘almost inevitable’ as markets seek clarity on trade policy direction. This sentiment aligns with recent institutional positioning and could provide a catalyst for Bitcoin’s next major move.

FAQ Section

How might Trump’s trade policies affect Bitcoin’s price?

Trade tensions and policy uncertainty typically increase Bitcoin’s appeal as a hedge against traditional market volatility.

What key price levels should traders watch?

Current support lies at $80,000, with resistance at $85,500. A break above $90,000 could signal a new upward trend.

How does the jobs report impact crypto markets?

Employment data influences Fed policy decisions, which can affect risk asset prices, including cryptocurrencies.