Ethereum Supply Crisis Looms: Exchange Reserves Hit 2-Year Low

Ethereum exchange reserves hit lowest levels since 2022 as supply squeeze potential builds. Analysis reveals critical $1,800 support amid 55% price decline f…

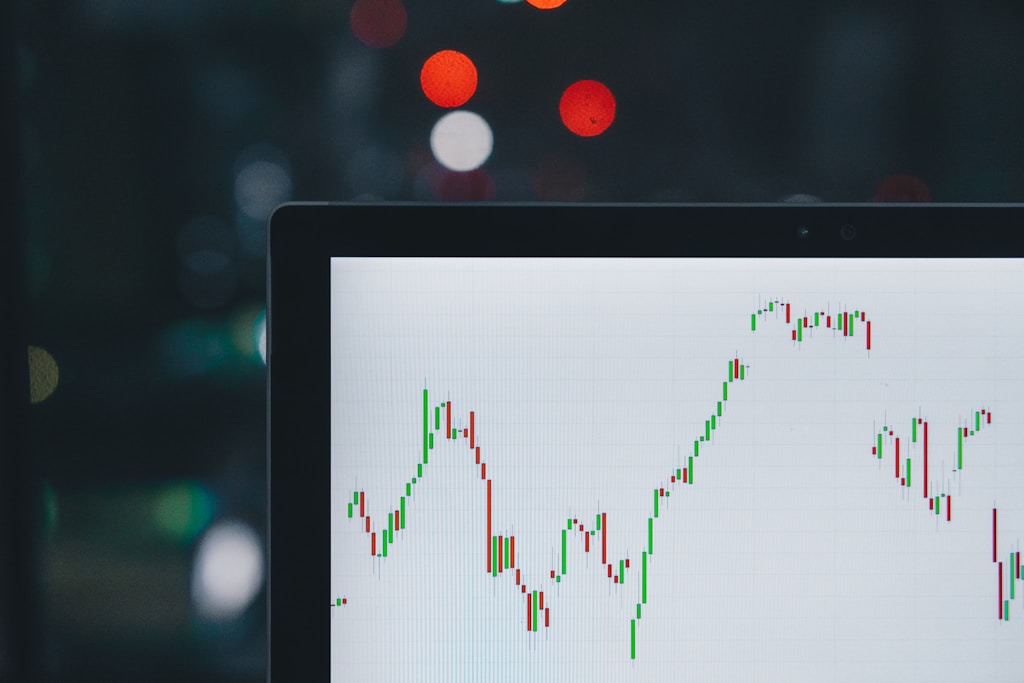

Ethereum’s exchange supply has reached a critical inflection point, with reserves plummeting to levels not seen since 2022. This dramatic shift comes as Trump’s aggressive trade policies continue rattling global markets, pushing ETH down 55% from December highs amid broader market uncertainty.

Exchange Supply Drain Signals Potential Squeeze

According to CryptoQuant data, Ethereum’s exchange reserves are experiencing a sustained decline, suggesting a significant reduction in sell-side pressure. This trend typically precedes major price movements, as reduced available supply can amplify upward momentum once buying pressure returns.

Technical Analysis: Critical Support Levels

ETH currently trades below $1,800, a crucial support zone that bulls must defend to prevent further downside. The weekly chart shows concerning breaks below both the 200-day MA ($2,500) and EMA ($2,250), suggesting continued bearish pressure.

Key Factors to Watch

- Exchange Supply: Continued decline could accelerate supply squeeze

- Support Level: $1,750-$1,800 range critical for preventing deeper correction

- Recovery Targets: Reclaiming $2,000 could signal trend reversal

FAQ

What does decreasing exchange supply mean for ETH price?

Reduced exchange supply typically indicates less selling pressure and can lead to price appreciation when demand increases.

How low could ETH go if $1,800 breaks?

A break below $1,800 could trigger a cascade to the next major support at $1,500.

When might we see a trend reversal?

Technical indicators suggest a potential reversal once ETH reclaims and holds above $2,000.

While current market conditions remain challenging, particularly amid growing recession concerns, the structural reduction in ETH supply could set the stage for a significant recovery once market sentiment improves.