Explore Solana: Top DeFi apps on the Solana blockchain

Explore the top DeFi applications on Solana, highlighting their unique features, fees, and benefits for traders and investors.

Solana is powering some of the fastest and most affordable DeFi platforms available today. With transaction fees under $0.01 and speeds of up to 65,000 transactions per second, it’s ideal for decentralized finance. Here’s a quick look at the top DeFi apps built on Solana and what they offer:

- Raydium: A hybrid DEX with $1.2B TVL, offering advanced trading tools, dual yield opportunities, and token launch support.

- Jupiter: Solana’s leading DEX aggregator, optimizing token swaps with smart routing and low costs.

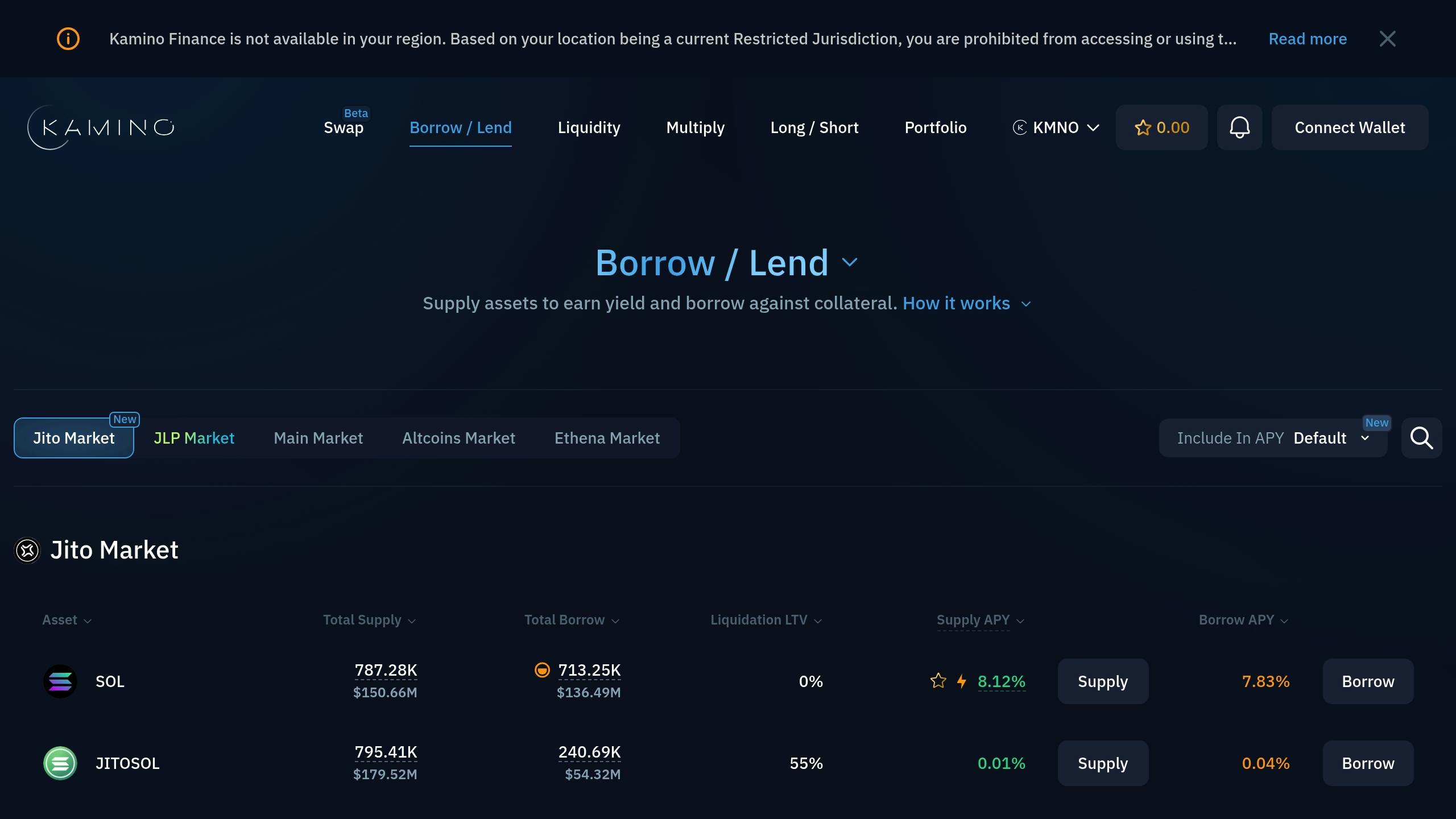

- Kamino Finance: Automated yield strategies with dynamic rebalancing and stop-loss features.

- Drift Protocol: A perpetual trading platform with up to 10x leverage and portfolio-wide collateral.

- Defx: High-leverage trading with up to 50x for futures and 20x for spot trades.

- Solend: Lending and borrowing platform managing 65% of Solana’s lending market with isolated pools and flash loans.

- Meteora: Concentrated liquidity pools for higher capital efficiency and reduced slippage.

- Orca: A user-friendly DEX with tools like Fair Price Indicator and targeted liquidity positions.

Quick Comparison

| Platform | Key Feature | Fees | Best For |

|---|---|---|---|

| Raydium | AMM + order book integration | 0.17-0.25% | Liquidity providers & traders |

| Jupiter | Best swap rates across DEXs | 0.0001 SOL | Token swaps |

| Kamino | Automated yield strategies | 10% on yields | Yield optimization |

| Drift | Perpetual trading with 10x leverage | 0.10% taker | Leveraged trading |

| Defx | High-leverage trading (50x futures) | 0.02-0.05% | Experienced traders |

| Solend | Lending with isolated pools | Dynamic | Lenders & borrowers |

| Meteora | Concentrated liquidity pools | Varies | Liquidity providers |

| Orca | Easy-to-use DEX with tools | 0.3% | Beginners & casual traders |

Start by choosing a platform that matches your needs – whether it’s swapping tokens, earning yields, or trading with leverage. Solana’s speed and affordability make it a strong choice for DeFi enthusiasts.

Top Decentralized Exchanges (DEXs) in the Solana Ecosystem

1. Raydium: Multi-Purpose DEX Platform

Raydium plays a key role in Solana’s DeFi ecosystem by combining an automated market maker (AMM) system with direct integration into Serum’s central limit order book (CLOB). This hybrid model has helped the platform lock in $1.2 billion in Total Value Locked (TVL) across over 150 liquidity pools [5].

Built on Solana’s fast infrastructure, Raydium offers advanced trading tools while staying user-friendly for casual traders. One of its standout features is Fusion Pools, which enhance project launches and liquidity incentives.

Here are some of its main trading features:

- Advanced Order Types: Includes TWAP orders and algorithmic trading via API [5][7].

- Concentrated Liquidity: Allows for 0.01% price increments, improving capital efficiency [5].

- Dual Yield Opportunities: Earn through trading fees (0.25%) and RAY token rewards [2].

Fusion Pools combine trading fees and token rewards, providing a unique dual incentive for liquidity providers. Raydium’s AcceleRaytor launchpad has already supported over 85 token launches [5].

For passive investors, Raydium offers multiple earning options:

- Liquidity pools with fees ranging from 0.17-0.25% plus RAY rewards.

- RAY staking, which offers 8-12% APY along with governance rights.

- Time-limited farms with returns of up to 45% APR.

Security is a priority for Raydium, with audits conducted by Ottersec and Kudelski. It also supports self-custody wallets like Phantom and Solflare [13][8].

Recently, Circle integrated USDC yield products directly into Raydium’s platform [1][8]. While the platform has faced challenges, such as price slippage exceeding 5% during high-demand periods like meme coin trading frenzies [13], it continues to showcase Solana’s ability to handle complex DeFi applications.

2. Jupiter: Advanced Token Swaps

Jupiter takes full advantage of Solana’s low-cost infrastructure, offering swaps at just 1/100th of the cost compared to Ethereum-based aggregators. As Solana’s top DEX aggregator, it handled over $2.1 billion in trading volume during the SOL price surge in October 2024 [8]. Its advanced swap aggregation algorithm scans multiple DEXs simultaneously, optimizing routes across 200+ trading pairs to secure the most favorable rates [5].

One standout feature of Jupiter is its smart order routing system. This system splits large trades across different liquidity sources – for example, directing 40% through Raydium and 35% through Orca. This reduces price impact while ensuring transactions remain atomic.

The platform also offers a range of advanced trading tools:

| Feature | Capability | Performance Metrics |

|---|---|---|

| Limit Orders | Expiration from 1 hour to 30 days | 400ms median swap time [7] |

| DCA Trading | Automated recurring swaps | 0.0001 SOL (~$0.015) per swap [7] |

Jupiter’s utility is further enhanced through integrations with other DeFi protocols. Users can swap directly into yield-generating positions via Kamino Finance vaults or use swapped assets as collateral on Solend – all within a single transaction [8]. Security is a priority, with quarterly audits conducted by OtterSec. The most recent v1.2 audit was completed in Q3 2024 [8].

"Jupiter accounts for over 60% of all DEX volume on Solana, with more than 1.1 million unique users" [9][15].

For developers and institutional traders, Jupiter offers a powerful API [8]. Features like real-time TradingView charts and visual route breakdowns improve transparency. Additionally, fee-free transaction simulations make it easier for new users to get started. All of this is built on Solana’s sub-second finality, maximizing efficiency and speed.

3. Kamino Finance: Automated Yield Strategies

Kamino Finance takes Jupiter’s efficient swapping capabilities a step further by automating yield generation with algorithm-based strategies. It dynamically allocates funds across lending markets and liquidity pools, using Solana’s ultra-fast block times to enable frequent rebalancing.

The platform’s system actively moves assets between protocols, such as lending platforms and DEX pools, while utilizing features like dynamic rebalancing and stop-loss mechanisms to manage risks effectively.

| Strategy | Returns |

|---|---|

| Concentrated Liquidity | 189% APY [5] |

| Yield Aggregation | 213% annualized [5] |

Kamino stands out for its ability to optimize across multiple protocols. It incorporates several advanced risk management tools, including:

- Dynamic rebalancing to adjust positions during market fluctuations

- Automatic stop-loss features to limit potential losses

- Portfolio diversification to reduce smart contract risks [5]

By tightly integrating with Solana’s ecosystem, Kamino taps into Serum’s order book [3][16], Raydium’s AMM pools [2][6], and Solend’s lending markets. This interconnected approach helps achieve higher compound yields through sophisticated strategies.

Kamino operates with a transparent fee structure, charging a 10% performance fee on generated yields. There are no extra fees for deposits or withdrawals [9].

4. Drift Protocol: Perpetual Trading

Drift Protocol offers a powerful platform for perpetual futures trading, providing tools designed for serious traders. It allows users to trade major cryptocurrencies like SOL, BTC, and ETH with leverage up to 10x [2].

The protocol uses a dynamic AMM liquidity model that adapts to market conditions, ensuring smooth price discovery and trade execution [3]. One of Drift’s standout features is its portfolio-wide collateral system, letting traders use their entire portfolio as collateral. This approach increases capital efficiency, similar to Kamino’s dynamic allocation, but tailored for leveraged trading [17].

| Feature | Details |

|---|---|

| Fees | 0.10% taker / 0.05% maker |

| Max Leverage | 10x |

Drift also prioritizes risk management. It includes real-time margin tracking and a gradual liquidation process to reduce the risk of sudden market crashes. An insurance fund backs the system, protecting traders and maintaining platform stability [5].

For advanced users, Drift supports a full suite of order types, including market and limit orders, stop-loss and take-profit triggers, trailing stops, and post-only execution [4].

The platform’s security measures are thorough. A price oracle redundancy system ensures accurate, manipulation-resistant pricing, while its open-source code invites community feedback and bug fixes.

"Drift’s cross-margined account system represents a significant innovation in Solana’s DeFi ecosystem, offering traders unprecedented capital efficiency while maintaining robust risk management", according to the platform’s documentation [15].

Drift integrates seamlessly with other Solana DeFi platforms, boosting liquidity and enabling advanced trading strategies. Traders can explore options like basis trading, delta-neutral strategies, and arbitrage, all supported by Solana’s lightning-fast block times and ultra-low transaction costs of $0.0001.

sbb-itb-dd9e24a

5. Defx: High-Leverage DEX Trading

Defx takes leveraged trading on Solana to the next level, offering traders a way to maximize their market exposure. With up to 20x leverage for spot trading and 50x leverage for perpetual futures, it’s designed for those looking to execute bold trading strategies [1]. Unlike Kamino, which focuses on yield automation, Defx zeroes in on providing high-leverage trading options.

Thanks to Solana’s ultra-fast infrastructure, Defx executes trades in under 400 milliseconds. This speed, combined with features like real-time position monitoring and auto-liquidation, ensures a seamless experience. By using portfolio-wide collateral and liquidity aggregation, Defx enables traders to execute complex strategies with confidence.

| Trading Feature | Details |

|---|---|

| Spot Trading Leverage | Up to 20x |

| Perpetual Futures Leverage | Up to 50x |

| Trading Fees | 0.02% – 0.05% |

Defx’s liquidity aggregation pulls resources from multiple sources, creating deep markets with minimal slippage [18]. For experienced traders, the platform offers advanced tools like limit orders, stop-loss, and take-profit orders [3]. Accurate pricing is ensured through real-time price feeds, reducing the risk of manipulation [17]. Additionally, a dynamic funding rate system helps maintain market balance [19].

On the security front, Defx employs multi-sig wallets, a dedicated insurance fund, and decentralized oracles to safeguard user assets. By combining high leverage with robust risk management and security features, Defx provides a powerful platform for traders to execute advanced strategies while keeping risks in check.

6. Solend: Lending and Borrowing

Solend serves as a key platform for lending and borrowing, offering tools for efficient capital deployment. Built on Solana’s high-speed network, Solend supports instant loan approvals and repayments, which are essential for leveraged strategies on integrated decentralized exchanges (DEXs). It holds about 65% of Solana’s lending market, with $500 million in Total Value Locked (TVL) and over $20 billion in lifetime volume [9][15].

The protocol uses an algorithmic interest rate model that adjusts automatically based on pool usage. This ensures competitive yields for lenders while keeping the market stable. Lenders typically earn 3-5% APY on stablecoins and 1-3% APY on major cryptocurrencies, while borrowers encounter rates ranging from 5-10% APR, depending on the asset and market conditions [9][10].

| Asset Type | Lending APY | Borrowing APR |

|---|---|---|

| Stablecoins | 3-5% | 5-8% |

| Major Cryptocurrencies | 1-3% | 6-10% |

| Other Tokens | Varies | Varies |

Solend enhances capital efficiency with its partial liquidation system, which also safeguards lenders [15]. Security is a priority, with quarterly audits and automated risk management systems in place [9]. Liquidators are charged a 0.5% fee during liquidations, ensuring stability even in volatile markets [10].

The January 2025 integration with Raydium significantly boosted activity on the platform, increasing daily users by 27% and borrowing volume by 42%, while adding $150 million in liquidity [9].

One of Solend’s standout features is its isolated lending pools. These allow for separate risk parameters across different assets, giving users the flexibility to adjust their strategies without taking on unnecessary risk. Cross-margin accounts further optimize user strategies, and flash loans enable advanced DeFi activities like arbitrage and debt refinancing [1][4].

7. Meteora: Concentrated Liquidity

Meteora boosts capital efficiency by using concentrated liquidity pools within specific price ranges. Liquidity providers focusing on narrow 5% price ranges can earn three times more in fees compared to traditional AMMs [1]. Thanks to Solana’s infrastructure, which supports sub-second trades, this setup also minimizes slippage, making it ideal for high-leverage platforms like Defx.

| Feature | Details |

|---|---|

| Capital Efficiency | Up to 3x higher than standard pools |

| Price Range Control | User-defined ranges |

| Multiple Fee Tiers | Adjusted for trading pair volatility |

Meteora supports all major tokens on Solana, helping users optimize their returns [15]. It works particularly well with high-volume trading pairs, where concentrated liquidity reduces slippage and improves trade execution.

For those looking to earn, Meteora provides multiple revenue options through its native MTR token. Token holders can participate in governance and earn a share of protocol fees [10]. Additionally, the platform allows single-asset liquidity provision, which helps manage risk [15].

After launching enhanced yield optimization tools in January 2025, daily trading volumes jumped by 42% [9]. Meteora showcases how Solana’s speed and efficiency enable liquidity models that wouldn’t be possible on slower blockchains.

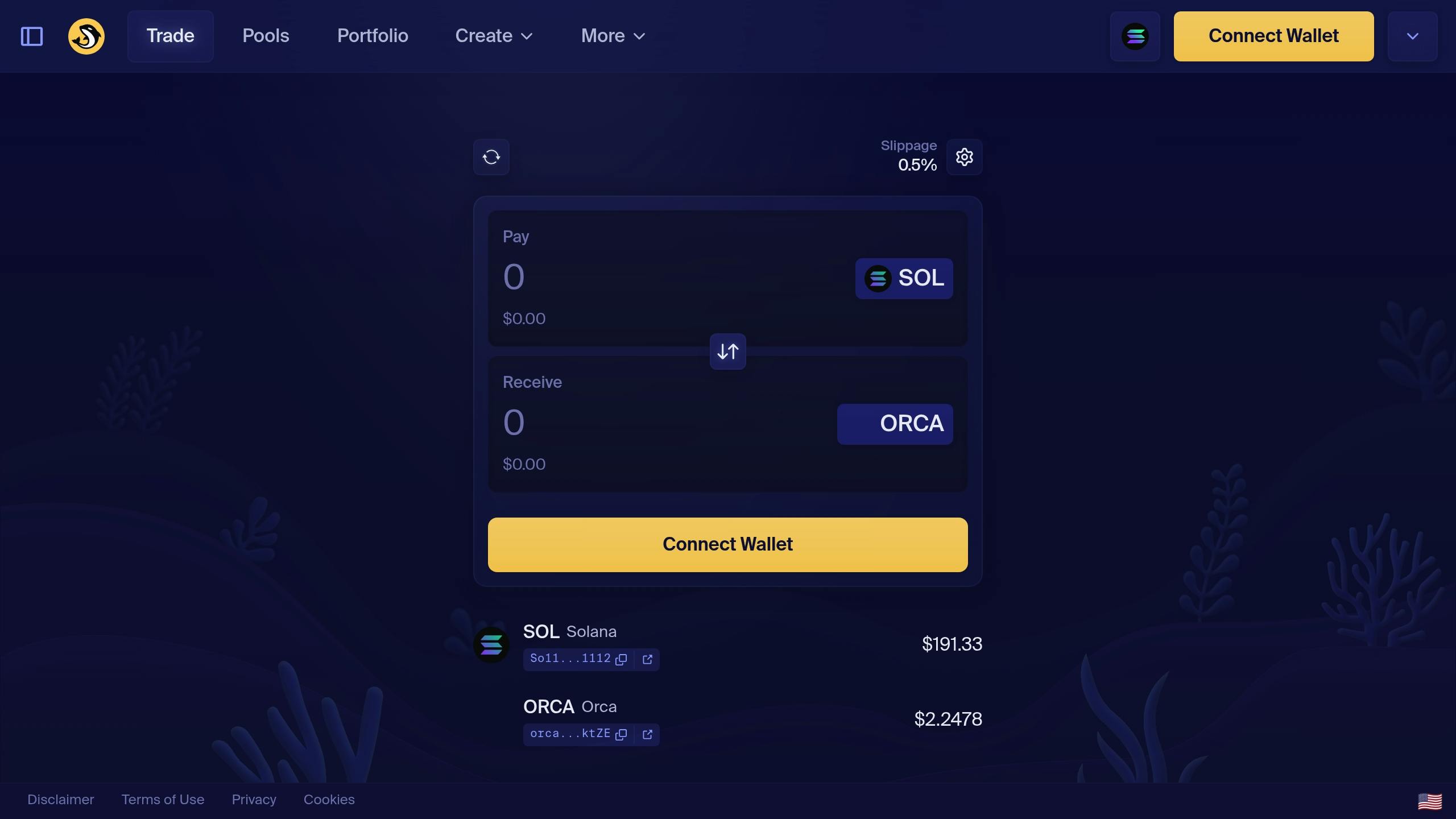

8. Orca: User-Focused DEX

Orca builds on Meteora’s liquidity features by offering a platform that combines an easy-to-use interface with tools designed for serious traders. With more than 500,000 users and $15 billion in total trading volume as of February 2025 [11], it has become a key player in Solana’s DeFi ecosystem.

One standout feature is the Fair Price Indicator, which helps users make smarter trades by comparing prices across various Solana DEXs in real time [1]. This color-coded tool shows whether a trade offers a good rate, working alongside Jupiter’s route optimization to ensure transparency.

| Feature | What It Does |

|---|---|

| Fair Price Indicator | Compares real-time market prices |

| Impact-adjusted pricing | Provides accurate quotes for large trades |

| Whirlpools | Allows for targeted liquidity positions |

| Aquafarms | Rewards users with ORCA tokens |

Whirlpools let users create targeted liquidity positions [5], while Aquafarms offer extra ORCA token rewards, with tiered rates for long-term stakers [5][11]. Together, these features have helped Orca maintain over $500 million in total value locked (TVL) [11].

For those looking to maximize returns, Aquafarms regularly adjust reward rates to stay competitive. Some pools even provide higher rewards based on how long tokens are staked [5].

Orca also prioritizes security [1]. This focus, paired with its intuitive design, has earned the platform a 4.7/5 rating from over 1,200 reviews on DeFi Pulse [11].

Handling $50 million in daily trading volume and $500 million in TVL [11], Orca supports 500,000 users through integrations with wallets like Phantom and Solflare. Like Raydium and Jupiter, it takes advantage of Solana’s fast transaction speeds and low fees, averaging just $0.0001 per trade [11]. New users can also explore DeFi concepts through Orca Academy, an interactive learning tool [9], making it a great entry point for those new to Solana.

DeFi Platform Features Comparison

Solana’s technical strengths allow its DeFi platforms to offer tailored solutions for users. These platforms stand out with their unique features and capabilities, catering to different needs.

For trading, Jupiter takes the lead, supporting over 500 tokens – far more than Raydium’s 250+ and Orca’s 100+ options [9][10][14]. Cost-conscious traders will find competitive fee structures across these platforms:

| Platform | Fees | Volume | Key Feature |

|---|---|---|---|

| Jupiter | 0-0.4% | $100-150M | Best swap rates [9] |

| Raydium | 0.25% | $50-80M | AcceleRaytor launches [2][12] |

| Solend | Dynamic | N/A | Isolated lending markets [5] |

| Orca | 0.3% | $30-50M | Fair Price Indicator [21] |

Platforms like Drift Protocol and Defx, built on Solana’s ultra-fast finality, offer advanced risk management tools for high-leverage trading.

For liquidity provision, Meteora and Orca shine with their concentrated liquidity pools, delivering benefits to both traders and liquidity providers [6].

The diversity of Solana’s ecosystem makes it accessible for all users. Beginners might prefer Jupiter’s easy-to-use aggregator, while advanced users can explore Defx’s 50x leverage options. Jupiter’s ability to process over $34 billion in trading volume in 2024 [9] highlights its efficiency in optimizing cross-DEX rates.

Summary and Next Steps

Now that we’ve reviewed Solana’s top DeFi platforms, here’s how you can start exploring this ecosystem effectively:

1. Get Started with Solana

Take advantage of Solana’s fast transaction speeds and extremely low costs:

- Acquire SOL tokens to cover transaction fees and trades.

- Solana’s ability to handle 65,000 transactions per second ensures quick execution [20].

2. Pick the Right Platform

Choose platforms based on your level of experience:

- Start with Jupiter for simple token swaps.

- Move to Raydium for providing liquidity.

- Explore advanced options like Defx or Drift for leverage trading.

3. Stay Secure

Protect your funds by following these security tips:

- Use hardware wallets for long-term storage [10].

- Begin with small amounts to familiarize yourself with each platform’s features.

Diversifying across platforms can help you maximize your opportunities. Solana’s speed, affordability, and growing ecosystem make it a promising choice for users at any experience level.