In a significant development for the Latin American crypto market, Itaú Unibanco, Brazil’s largest banking institution, has revealed plans to enter the stablecoin sector, marking a pivotal moment in the region’s digital currency evolution. This strategic move comes as stablecoin regulation gains momentum globally, with the bank taking a measured approach while awaiting clear regulatory frameworks.

Strategic Timing and Market Impact

Itaú Unibanco’s potential stablecoin initiative represents a calculated response to the growing demand for digital payment solutions in Brazil’s rapidly evolving fintech landscape. The bank’s cautious approach, particularly its emphasis on learning from U.S. banking experiences, demonstrates a commitment to sustainable innovation in the digital currency space.

Regulatory Considerations

The bank’s decision to await final stablecoin regulations before proceeding highlights the complex regulatory environment surrounding digital currencies in Brazil. This approach aligns with broader trends in global financial markets, where institutions are increasingly seeking regulatory clarity before launching digital currency products.

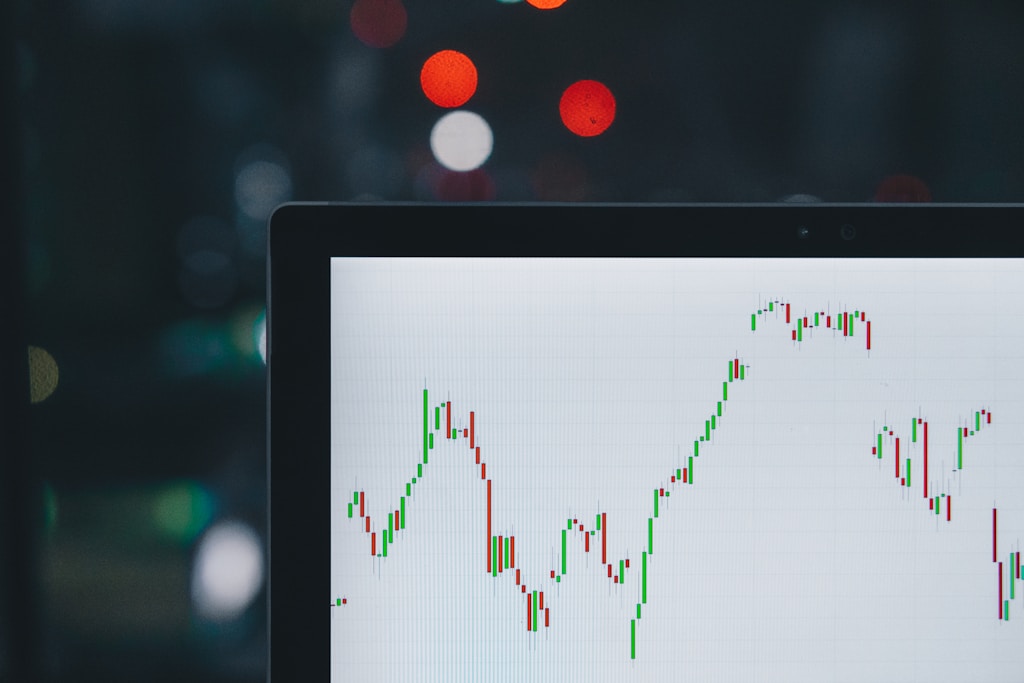

Market Implications and Future Outlook

The entry of Brazil’s largest bank into the stablecoin market could significantly impact the country’s digital currency landscape. This development coincides with Brazil’s broader initiatives in digital currency adoption, particularly within the BRICS context.

FAQ Section

What is the timeline for Itaú Unibanco’s stablecoin launch?

The exact launch timeline remains pending, contingent upon regulatory clarity in Brazil’s digital currency sector.

How will this affect Brazil’s crypto market?

The introduction of a bank-backed stablecoin could enhance institutional adoption and market stability in Brazil’s crypto ecosystem.

What regulatory hurdles remain?

The bank awaits comprehensive stablecoin regulations and aims to align with both domestic and international compliance standards.