The controversial WAP (Wet A*s P*ssy) token experienced a dramatic 90% price crash following a promotional tweet from rapper Cardi B, raising serious concerns about potential market manipulation. The incident bears striking similarities to recent celebrity-endorsed token controversies that have plagued the crypto space.

Market Impact and Price Analysis

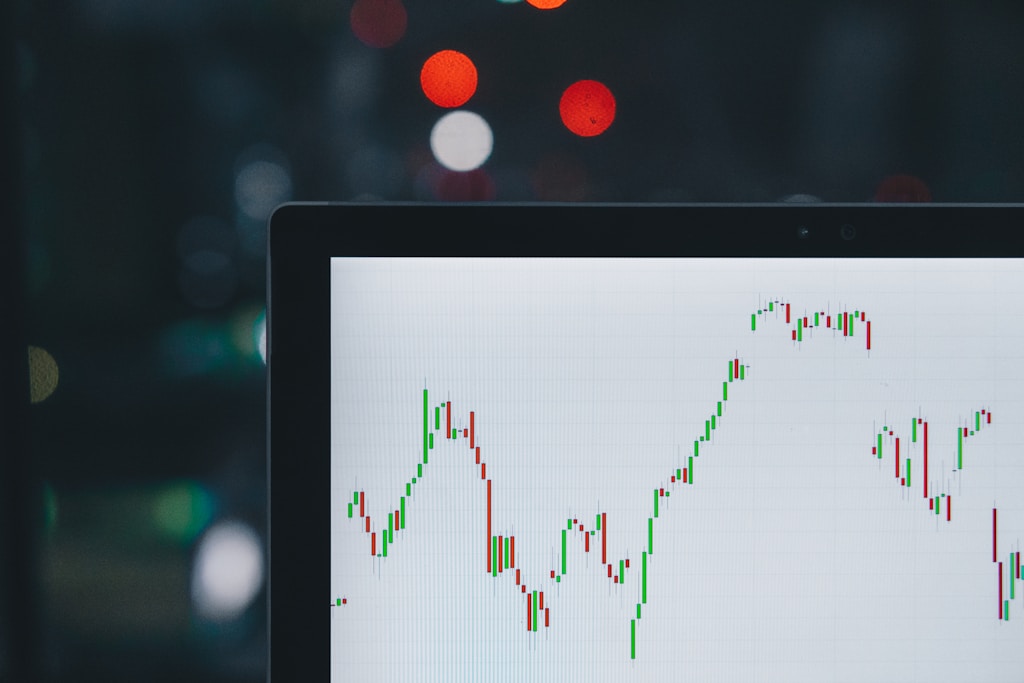

Within minutes of Cardi B’s tweet, which included a wallet address and the caption “even wetter than last time,” WAP’s market capitalization plummeted from $2 million to just $150,000. The token briefly spiked to $0.0020 before crashing to $0.00019, effectively erasing all gains from the past week.

Evidence of Coordinated Trading Activity

Blockchain analysis revealed suspicious trading patterns that suggest a coordinated pump-and-dump scheme:

- Multiple wallets accumulated large WAP positions 5 days before the tweet

- Immediate sell-offs occurred post-tweet, generating 10x returns

- Trading volume spiked 500% during the event

Historical Context and Regulatory Implications

This isn’t WAP’s first controversy. The token faced scrutiny in October 2024 when security firm PeckShield flagged potential malicious activity. The UAE’s Securities and Commodities Authority launched an investigation following fraud allegations.

Impact on Investors

The latest incident has resulted in significant losses:

- 80% value decrease in 24 hours

- Return to pre-pump price levels

- Retail investors left with devalued holdings

Expert Analysis and Future Implications

Cryptocurrency security experts warn this incident highlights the ongoing risks of celebrity-endorsed tokens and the need for stronger regulatory oversight in the meme coin sector.

FAQ Section

Q: Is the WAP token legitimate?

A: Multiple security firms have flagged suspicious activity associated with the token.

Q: Can investors recover their losses?

A: Currently, there are no established mechanisms for recovery in such cases.

Q: What are the warning signs of a pump-and-dump scheme?

A: Key indicators include celebrity endorsements, sudden price spikes, and coordinated social media promotion.