Leading cryptocurrency exchange OKX has officially launched its operations in the United States, marking a significant expansion in the competitive US digital asset market. The launch includes both a centralized cryptocurrency exchange and the OKX Wallet, with the company establishing its regional headquarters in San Jose, California.

Key Highlights of OKX’s US Launch

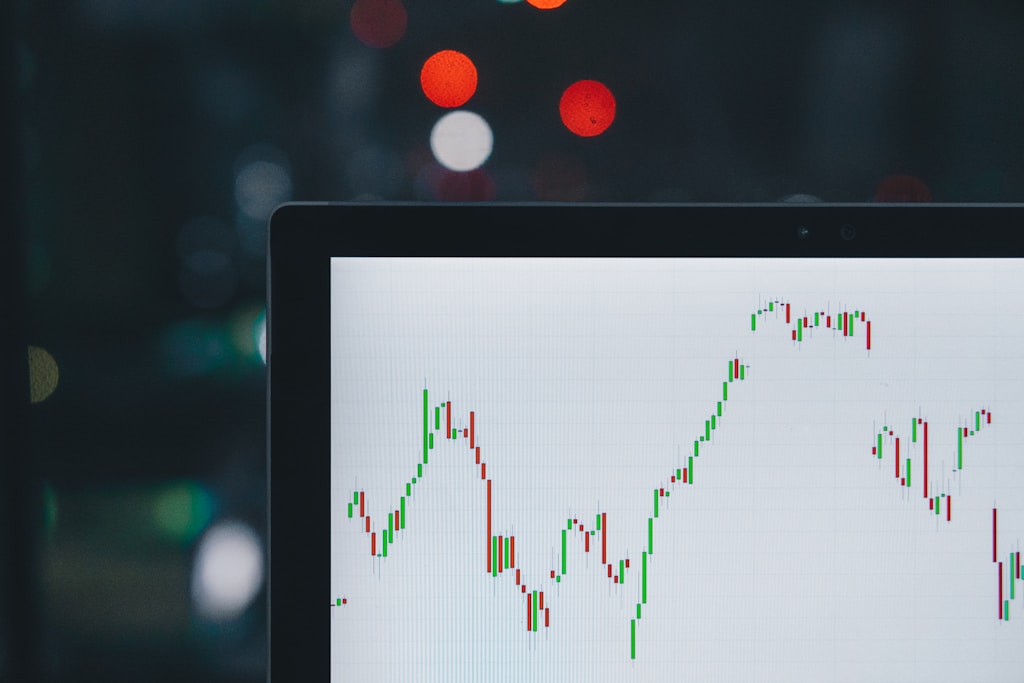

- Centralized cryptocurrency exchange platform

- OKX Wallet integration for US customers

- Regional headquarters in San Jose, California

- Appointment of Roshan Robert as US CEO

This strategic move comes at a crucial time when cryptocurrency exchange practices are under increased scrutiny, making OKX’s commitment to regulatory compliance particularly noteworthy.

Leadership and Regulatory Compliance

Under the leadership of newly appointed US CEO Roshan Robert, OKX emphasizes its dedication to providing secure and compliant digital asset services to American customers. This approach aligns with the growing demand for regulated cryptocurrency services in the US market.

SPONSORED

Trade with confidence using advanced security features and up to 100x leverage

Market Impact and Future Outlook

The entry of OKX into the US market represents a significant development in the cryptocurrency exchange landscape, potentially increasing competition and innovation in the sector. This expansion could contribute to greater market depth and improved services for US-based crypto traders and investors.

FAQ Section

What services will OKX offer in the US?

OKX will provide a centralized cryptocurrency exchange platform and the OKX Wallet service to US customers.

Where is OKX’s US headquarters located?

The company has established its regional headquarters in San Jose, California.

Who is leading OKX’s US operations?

Roshan Robert has been appointed as the US CEO to lead OKX’s American operations.