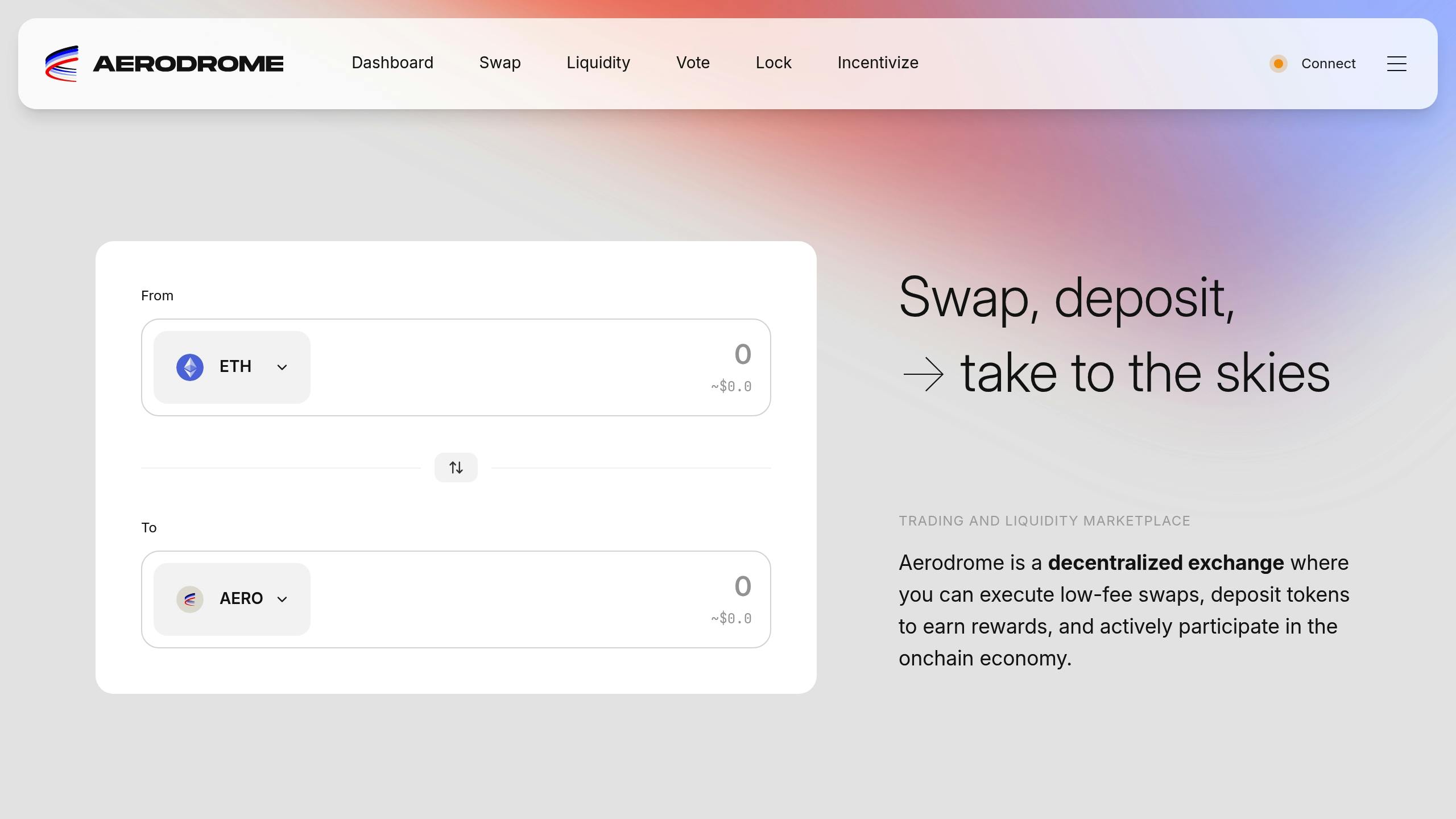

What is Aerodrome Finance? How is it different vs Uniswap?

Explore the key differences between two decentralized exchanges, focusing on their unique token systems, governance, and liquidity features.

Aerodrome Finance and Uniswap are both decentralized exchanges (DEXs) in the DeFi space, but they serve different purposes and operate on distinct systems. Here’s a quick breakdown:

- Aerodrome Finance: Built on the BASE network, it uses a dual-token system ($AERO and $veAERO) for utility and governance. It focuses on community-driven liquidity incentives and long-term participation through vote-lock mechanisms (up to 4 years). Launched in 2023, its market cap is $593.6M as of February 2025.

- Uniswap: A pioneer in the AMM model, it operates on multiple chains (primarily Ethereum) with a single governance token (UNI). It offers large liquidity pools, universal token swaps, and a straightforward governance system with no lock periods. Its market cap stands at $5.6B as of February 2025.

Quick Comparison

| Feature | Aerodrome Finance | Uniswap |

|---|---|---|

| Network | BASE | Multiple chains (Ethereum) |

| Governance Token | $veAERO (NFT-based) | UNI |

| Lock Period | Up to 4 years | None |

| Market Cap (Feb 2025) | $593.6M | $5.6B |

| Focus | Liquidity incentives | Universal token swaps |

| Gas Fees | Lower (BASE network) | Higher (Ethereum congestion) |

| Slippage Control | Incentive engine | Standard AMM model |

Aerodrome prioritizes reduced slippage, faster transactions, and community participation, while Uniswap focuses on flexibility, multi-chain liquidity, and simplicity. Choose Aerodrome for advanced liquidity incentives and governance, or Uniswap for broader market access and established reliability.

Here’s Why Aerodrome Might Be Better Than Uniswap

How Aerodrome Finance Works

Aerodrome Finance brings together liquidity pools, governance, and safety measures to create a reliable decentralized exchange (DEX). These features help it stand out in the competitive world of decentralized trading.

Liquidity Pool Structure

Liquidity incentives are determined through community voting, ensuring that the most important trading pairs attract the necessary liquidity.

| Pool Feature | Implementation | Benefit |

|---|---|---|

| Emissions Distribution | Allocated by votes | Focuses liquidity where needed |

| Reward Structure | Time-based schedule | Provides consistent earnings |

| Pool Management | Community-led | Adapts to market needs |

Token System and Voting

Aerodrome Finance’s token system is designed to encourage long-term participation and engagement:

$AERO (Utility Token)

- Acts as the main token of the protocol.

- Distributed as rewards for providing liquidity and can be locked to gain governance rights through $veAERO.

$veAERO (Governance Token)

- Issued as ERC-721 NFTs.

- Achieved by locking $AERO for up to 4 years.

- Offers voting power and a share of trading fee revenue.

This governance model gives $veAERO holders the ability to shape key protocol decisions, like adjusting emission rates and liquidity distribution. This ensures the platform remains influenced by its community.

Platform Design and Safety

The platform minimizes slippage through a scheduled reward system, which ensures predictable earnings and supports overall stability. Decentralized governance is integrated into safety protocols, reinforcing the platform’s focus on community oversight. Additionally, users actively participate in important decisions, helping to maintain a secure and dependable trading environment.

sbb-itb-dd9e24a

Aerodrome Finance vs Uniswap

Aerodrome Finance and Uniswap stand apart in terms of network performance, token mechanics, and trade execution.

Speed and Efficiency

Aerodrome Finance leverages the BASE network to deliver faster and more affordable transactions. Its incentive engine reduces slippage, ensuring smoother trades compared to Uniswap’s standard model.

| Feature | Aerodrome Finance | Uniswap |

|---|---|---|

| Network | BASE | Ethereum |

| Gas Fees | Lower (due to BASE) | Higher (due to Ethereum congestion) |

| Slippage Control | Incentive engine | Standard AMM model |

| Transaction Speed | BASE-optimized | Dependent on Ethereum |

Token Mechanics

The platforms also differ in their token models and governance systems. Aerodrome Finance introduces a vote-lock system that emphasizes community participation, while Uniswap relies on a direct token voting approach.

| Token System | Aerodrome Finance | Uniswap |

|---|---|---|

| Governance Token | $veAERO | UNI |

| Token Price | $0.777 | $9.372 |

| Voting Mechanism | Vote-lock governance | Direct token voting |

Trading Features

When it comes to trading, Aerodrome Finance integrates features from Velodrome V2, enhancing its functionality. Uniswap, on the other hand, benefits from its established reputation and wider market accessibility.

Liquidity management is another key difference. Aerodrome Finance uses its vote-lock governance and Velodrome V2 integration to offer a unique approach to liquidity and protocol control. This is further underscored by its recent allocation of over 100,000 OP tokens from RetroPGF, signaling growing recognition in the DeFi space.

Aerodrome Finance focuses on community-driven liquidity allocation, while Uniswap offers larger, more diverse liquidity pools. These contrasting strategies cater to different trading preferences, helping users choose the platform that suits their needs best.

Aerodrome Finance’s Main Benefits

Trading Tools

Aerodrome Finance offers a range of tools designed to improve trading efficiency. Its liquidity incentive system minimizes slippage, while the integration of Velodrome V2 provides advanced trading capabilities. The platform also uses a vote-lock governance model to allocate liquidity effectively. With deep liquidity pools and AERO currently priced at $0.819, traders have access to a cost-effective entry point. These features also make Aerodrome compatible with broader DeFi ecosystems.

DeFi Compatibility

Built on the BASE network, Aerodrome Finance ensures smooth interaction with various DeFi protocols. Its Velodrome V2 integration enhances trading processes and cross-protocol compatibility, making transactions more efficient and less prone to slippage. A recent allocation of over 100,000 OP tokens through RetroPGF highlights its growing presence in the DeFi landscape.

| Integration Feature | Benefit |

|---|---|

| BASE Network | Connects seamlessly with multiple DeFi protocols |

| Velodrome V2 Features | Boosts trading efficiency and functionality |

| Cross-Protocol Compatibility | Enables smooth interaction with DeFi services |

| Liquidity Incentive Engine | Reduces slippage and improves trade execution |

In addition to these operational advantages, Aerodrome prioritizes security to protect user assets.

Safety Features

The platform employs a decentralized governance model to enhance security. Its dual-token system – $AERO for utility and $veAERO for governance – gives users control over emission rates and liquidity management, helping to limit risks.

| Security Element | Implementation |

|---|---|

| Governance Structure | Vote-lock system using $veAERO tokens |

| Community Control | Decentralized decisions on emission rates |

| Risk Management | Community-driven allocation of liquidity |

Summary of Key Differences

The platforms cater to different trading needs, offering unique features and approaches.

Aerodrome Finance vs. Uniswap

Aerodrome Finance operates on Velodrome V2 within the BASE network, prioritizing quicker trades and minimizing slippage. On the other hand, Uniswap, built on Ethereum, boasts a massive market cap of $5.6 billion compared to Aerodrome’s $593.6 million, reflecting its dominant market presence.

A major distinction lies in their token systems. Aerodrome employs a dual-token setup: $AERO for utility and $veAERO for governance, encouraging active community involvement. Uniswap simplifies this with a single token, UNI, handling both utility and governance, offering a less complex framework.

| Feature | Aerodrome Finance | Uniswap |

|---|---|---|

| Network | BASE | Ethereum |

| Token System | Dual ($AERO + $veAERO) | Single (UNI) |

| Governance Model | Vote-lock mechanism | Standard governance |

Choosing the Right Platform

- Opt for Aerodrome Finance if your focus is on reduced slippage, active governance through vote-locking, BASE network integration, and additional rewards.

-

Go with Uniswap if you prefer:

- Access to large liquidity pools and a well-established market presence

- A straightforward AMM trading experience

- Compatibility with the broader Ethereum ecosystem

- Simplified token usage with unified utility and governance

While Aerodrome’s OP token allocation reflects growing confidence in its approach, Uniswap’s established reputation and market dominance make it a dependable option for traders prioritizing proven reliability.