Key Takeaways:

- Bitcoin surges past $85,000 following Fed’s quantitative tightening slowdown announcement

- Rate cuts expected as early as June 2025

- Market sentiment turns bullish amid policy shift

Bitcoin’s price catapulted beyond the $85,000 mark in a dramatic surge following the Federal Reserve’s latest policy announcement. As anticipated by market analysts, the Fed’s decision to slow quantitative tightening has sparked renewed optimism across crypto markets.

Fed Policy Shift: A Catalyst for Bitcoin’s Rally

The Federal Reserve’s hawkish-to-dovish transition marks a significant shift in monetary policy, with implications reaching far beyond traditional markets. This development aligns with earlier predictions of a Bitcoin price reversal tied to the end of quantitative tightening.

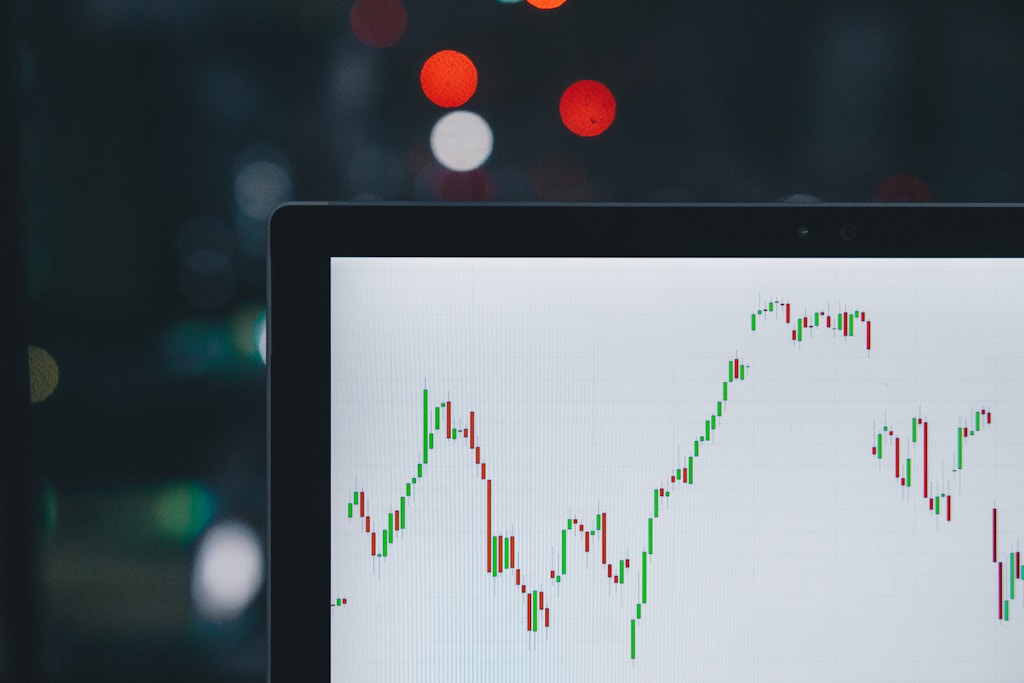

Market Impact and Technical Analysis

The immediate market response has been overwhelmingly positive, with Bitcoin’s price action suggesting strong institutional backing. Trading volumes have surged across major exchanges, indicating broad-based participation in the rally.

SPONSORED

Maximize your Bitcoin trading potential with up to 100x leverage on perpetual contracts

Looking Ahead: June Rate Cuts

With rate cuts now projected for June, market participants are positioning for potentially higher Bitcoin prices. However, analysts urge caution, noting that market volatility could increase in the lead-up to these policy changes.

FAQ Section

- Q: What triggered Bitcoin’s latest price surge?

A: The Federal Reserve’s announcement to slow quantitative tightening and potential rate cuts in June. - Q: What are the key resistance levels to watch?

A: The next major resistance levels are at $87,500 and $90,000. - Q: How might this affect other cryptocurrencies?

A: Historically, Bitcoin’s strong performance has led to positive momentum across the broader crypto market.